- BDO Unibank

- About BDO

- Learn

- News and Features

Welcome to BDO News and Features!

Read about BDO’s latest developments and stories.

News and Features

19 Nov 2025 | 1 min read

Important Advisory: Beware of Fake Content

We are aware of videos circulating online involving our senior leaders. Please be informed that these videos are FAKE and do not represent our organization.

28 Oct 2025 | 2 min read

BDO net income reaches ₱63.1 billion in 9M 2025

BDO Unibank, Inc. (BDO) recorded a net income of ₱63.1 billion in the first nine months of 2025, an increase by 4% from ₱60.6 billion last year due to sustained performance of its core business segments. Return on Average Common Equity (ROCE) stood at 14.1% for the period.

17 Oct 2025 | 2 min read

How one sweet business is rising fast with the right ingredients

“Your perfect circle of happiness”—that’s what Harold Alfonso set out to create when he launched Donut Park, a Korean-inspired venture that’s now delighting customers across Luzon and other key areas in the country. Since opening its first outlet in July 2023, it has grown to over 150 franchise partners, with no signs of slowing down.

15 Oct 2025 | 2 min read

5 reasons why smart travelers never skip travel insurance

You’ve planned every detail of your getaway, from flights and hotels to sightseeing and festive dining. But even the best-laid plans can hit a snag, especially during the busy holiday season. These ’ber months, enjoy your upcoming vacation without the stress of costly travel disruptions from unforeseen events. Experts agree: travel insurance is a smart move—and here are 5 key reasons why savvy travelers swear by it.

14 Oct 2025 | 1 min read

#AlagangKabayan Money Tip from Piolo

Here’s a money-wise tip from actor Piolo Pascual for Overseas Filipinos: Subukan ang winning combo ng BDO Kabayan Savings at BDO Pay para makatipid sa transaction fees. BDO Pay is an everyday payment app that lets you scan, send, and pay almost anywhere. No need to cash in—simply link your BDO Kabayan Savings and other BDO accounts or credit cards.

10 Oct 2025 | 2 min read

BDO Kabayan Facebook Page wins at the 21st Philippine Quill Awards

BDO Unibank Inc.’s (BDO) BDO Kabayan Facebook Page earned recognition at the 21st Philippine Quill Awards for excellence in Social Media Strategy. The award underscores the Bank’s Alagang Kabayan commitment, which is further demonstrated in BDO Kabayan Facebook Page—delivering accurate, timely, and informative financial advice and service updates that will surely help overseas Filipinos (OFs) and their families with their daily transactions and long-term dreams.

08 Oct 2025 | 1 min read

BDO supports Peñafrancia pilgrims in Naga

BDO Unibank, Inc. (BDO) is joining the faithful in Naga City this September by extending a simple gesture of care: providing free umbrellas to Peñafrancia pilgrims.

08 Oct 2025 | 1 min read

Advisory

The driving principle behind the Bank’s board-approved Energy Transition Finance Statement (ETFS) is the commitment to support and align with the government’s energy transition priorities to ensure energy security.

03 Oct 2025 | 2 min read

BDO ensures continued banking access in Bogo City to serve affected community

When a magnitude 6.9 earthquake struck Bogo City, Cebu, BDO Unibank responded swiftly and now serves as a vital lifeline for Bogo City residents, ensuring they have continued access to cash and other critical banking services during a time of need.

17 Sep 2025 | 2 min read

BDO powers green mobility in the PH with Vietnam’s VinGroup partnership

Have you spotted those green taxis cruising through Metro Manila? Travelers now have an eco-friendly choice on the road. They are the country’s first all-electric taxi fleet, powered by VinFast vehicles and operated by Green GSM Philippines. Offering a smoother, quieter and cleaner ride, these cabs mark the beginning of a new commuting experience for Filipinos.

12 Sep 2025 | 2 min read

Giving back this Grandparents’ Day and throughout the year

Your grandparents have always been there for you—offering words of encouragement and unconditional love—making life richer in countless ways. This Grandparents’ Day, it’s time to honor them with the comfort and security they deserve in their golden years.

12 Sep 2025 | 2 min read

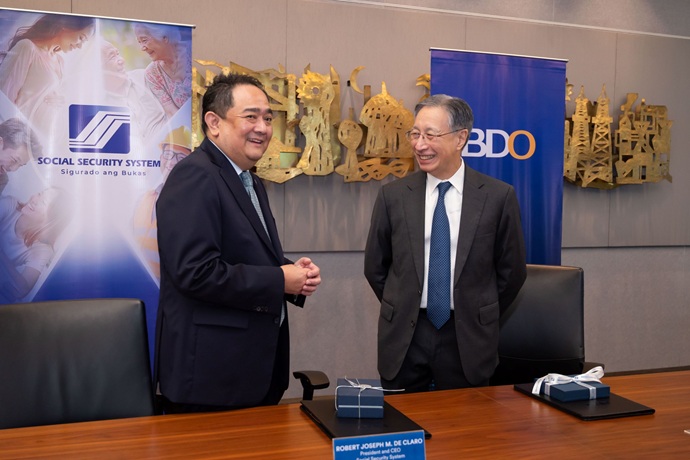

BDO named trustee for SSS balanced fund mandate

The SSS awarded BDO as trustee for a Balanced Fund mandate, a partnership that reaffirms BDO’s credibility, expertise, and leadership in institutional fund management.

10 Sep 2025 | 3 min read

How Kabayans can stay connected 24/7, wherever they are, with BDO Pay

Overseas Pinoys who discover BDO Pay share the same sentiment: “Hulog ng langit!” Malayo sa pamilya, many go the extra mile to stay connected, through text, calls, and social media. They ensure that the fruits of their hard work can reach their families securely when they need it, by putting their trust in BDO Unibank.

08 Sep 2025 | 2 min read

BDO drives sustainable growth for the PH’s largest homegrown retail brand

“From the very start, we recognized that partnering with a trusted bank was fundamental to the success of our business,” said Virgilio Lim of Suyen Corporation. “What began as a purely depository relationship with BDO has evolved into a comprehensive partnership, from credit lines and co-branded products to capital loans, that continues to support our growth today.”

05 Sep 2025 | 2 min read

Keep your children’s dreams alive with a Plan B

“I want to be like you, Mama.” The words every parent wishes to hear, hoping their children will carry with them always. Your children’s dreams know no bounds – becoming a doctor, building bridges or following in your artistic footsteps.

02 Sep 2025 | 3 min read

BDO Fiesta celebrates loyalty of clients across generations

Kun tama an saimong katuwang na bangko maheheling mo an pagtalubo kan saimong mga pangaturogan sa pag agi kan panahon. Ini an katotohanan para sa mga pamilya kan haloyon nang kliyente ninda, Atty Sylki Balagtas asin Emily Yao. (When you have the right bank partner, you can watch your dreams become reality through generations. This is certainly true for the families of long-time clients Atty. Sylki Balagtas and Emily Yao.)

01 Sep 2025 | 2 min read

Because life can give you lemons, make sure you own insurance

What’s better than making lemonade when life gives you lemons? This popular saying encourages optimism and resilience in the face of challenges. But while it’s good to remain positive amidst difficulties, you can choose to be one step ahead simply by owning life insurance.

29 Aug 2025 | 1 min read

BDO and CFO forge partnership to empower Overseas Filipinos

BDO Unibank (BDO) and the Commission on Filipinos Overseas (CFO) recently formalized their partnership to provide permanent migrant Filipinos with easier access to information, services, and guidance through financial literacy programs.

26 Aug 2025 | 2 min read

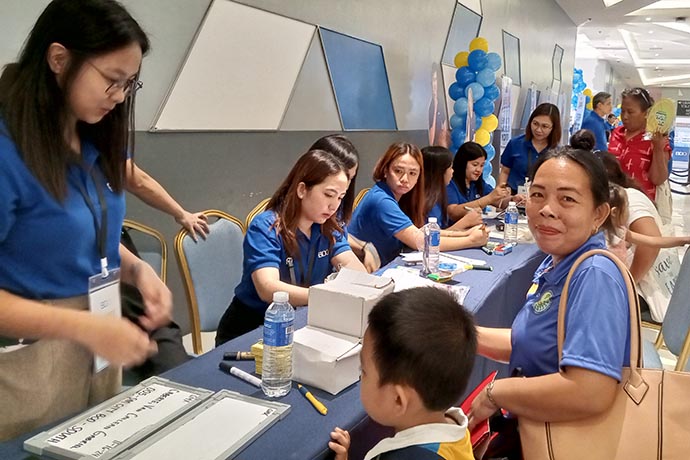

Discover all your banking solutions in BDO Fiesta

Thousands came for the vibrant events, with special deals and celebrities, but what made them show up and stay? Throughout June and July, BDO showcased its full suite of banking services across Bicolandia, bringing a deeper connection to communities and engaging consumers and entrepreneurs in moments of fun and purposeful activities.

22 Aug 2025 | 2 min read

Alden Richards at BDO branch

Alden Richards cuts a confident figure on both the small and the big screen as he tackles many challenging roles. But in his most recent video, no acting needed where Alden is shown as one very happy BDO client.

20 Aug 2025 | 2 min read

Less stress, more success with BDO’s business solutions

Entrepreneur Bernardo Borlagdan is on a path to transform the way he runs his businesses. With ventures in hardware, construction, and laundromat located in Albay and Metro Manila, he envisions a future driven by automation—one that simplifies operations and boosts efficiency.

11 Aug 2025 | 2 min read

With BDO Insure, your ₱1 a day can go a long way against dengue

The rainy season may bring a welcome break from the scorching summer, but it also comes with its own set of challenges. From worsening traffic to flu season to higher incidence of dengue.

07 Aug 2025 | 2 min read

BDO subsidiary posts ₱71.6 million income in 1H 2025

Dominion Holdings, Inc. (DHI, formerly BDO Leasing and Finance, Inc.) reported a net income of ₱71.6 million in the first half of 2025, compared to ₱134.5 million during the same period in 2024. The decline was mainly due to the reduction in investable funds following the declaration of ₱3.2 billion in cash dividends in May 2024, as well as a lower interest rate environment.

06 Aug 2025 | 2 min read

BDO and Remitly make real-time remittances a reality for Overseas Filipinos

Whether it’s midnight in California or noon in Manila, Overseas Filipinos and their families share one common need: reliable and secure remittance services. For Overseas Pinoys, sending hard-earned money home is not just a transaction: it’s tuition, groceries, and bills. When they are a thousand miles away, who can they call for help?

04 Aug 2025 | 2 min read

BDO makes Tuesdays extra special for Overseas Filipinos and their families

“Yay, Tuesday na!” Every first Tuesday of the month, the daughter of a former Overseas Filipino Roselle Padua would eagerly announce this to her family, already planning her day. For the teenager, the seemingly ordinary day has become special.

04 Aug 2025 | 2 min read

Bank like Alden Richards with BDO

Whether you're choosing from the many banks around the corner or exploring banking through your phone or laptop, picking the ideal bank partner is not always easy.

01 Aug 2025 | 2 min read

Belle Mariano makes BDO Pay a family affair

Belle Mariano is booked and busy, with her schedule packed full of shoots, filming, guest appearances, rehearsals and more. But she always makes sure to take a break so she can spend time with family.

30 Jul 2025 | 2 min read

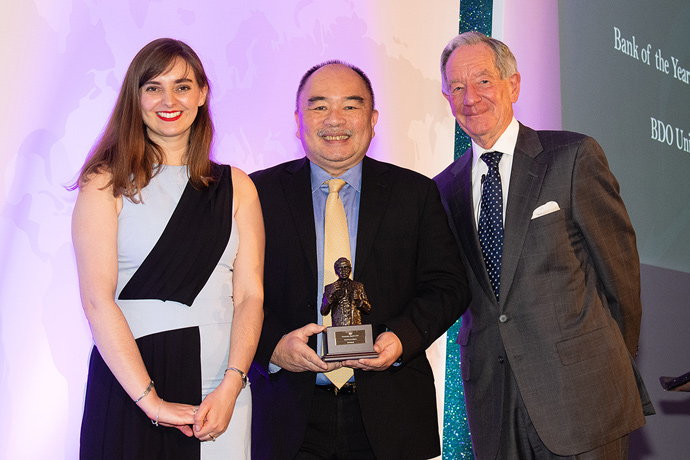

BDO Foundation fin ed program for farmers wins Asian Banking & Finance award

KITA (Kapital at Ipon Tungo sa Asenso) Mo Na! —a financial education program of BDO Foundation—was recognized as Financial Inclusion Initiative of the Year at the Asian Banking & Finance (ABF) Retail Banking Awards 2025. The program aims to support the agricultural sector by improving the financial literacy, productivity, and income-generating capabilities of farmers nationwide.

29 Jul 2025 | 1 min read

BDO raises PHP 115 billion in fourth ASEAN Sustainability Bond issue

BDO Unibank, Inc. (“BDO” or the “Bank”) successfully raised PHP 115 billion for its fourth Peso-denominated ASEAN Sustainability Bond issue, twenty-three times oversubscribed against the original offer of PHP 5 billion.

28 Jul 2025 | 2 min read

BDO reports ₱40.6 billion income in 1H 2025

BDO Unibank, Inc. (BDO) generated a net income of ₱40.6 billion in 1H 2025, up 3% from ₱39.4 billion last year, driven by strong performance from its core businesses. Earnings growth was tempered by the continuing investments in market coverage and IT spending for operational efficiency. Return on Average Common Equity (ROCE) stood at 13.9% for the period.

24 Jul 2025 | 2 min read

Payroll efficiency matters: How three businesses upgraded theirs with BDO

For small and medium enterprises (SMEs), managing payroll can be a time-consuming and daunting task. Calculating salaries, handling taxes, and releasing bi-monthly pay can be prone to errors, especially when done manually. By choosing the right bank, businesses can streamline payroll management, freeing up time for growth expansion without distractions.

23 Jul 2025 | 2 min read

Kyoto firms visit BDO to advance trade and talent ties

As Japanese companies diversify their international footprint to drive regional growth, BDO Unibank Inc. (BDO) reinforced its commitment to supporting foreign investors by hosting a delegation from the Kyoto Employers Association (KEA) at BDO Makati.

21 Jul 2025 | 2 min read

Grow your family’s savings, secure your golden years with BDO

Planning to open bank accounts for the whole family? Why not make the smart choice where you and your loved ones can grow your money at every life stage? From early saving habits to retirement plans, there is a trusted financial solution for every family’s need.

21 Jul 2025 | 3 min read

BDO's sustainable financing surpasses ₱1 trillion mark

BDO Unibank Inc. (BDO) continues to champion sustainable finance by supporting initiatives that promote inclusive growth, environmental stewardship, and long-term economic resilience. Since launching its Sustainable Finance Program in 2010, BDO has funded P1.04 trillion in sustainable projects across energy, infrastructure, water, transportation, and community development sectors.

18 Jul 2025 | 2 min read

BSP, BDO Foundation launch new e-learning modules

As part of a shared mission to make financial education accessible to more Filipinos, the Bangko Sentral ng Pilipinas (BSP) and BDO Foundation launched six new financial education e-learning modules. These modules complete the target of both organizations to produce a total of nine that are accessible through the BSP E-Learning Academy.

16 Jul 2025 | 2 min read

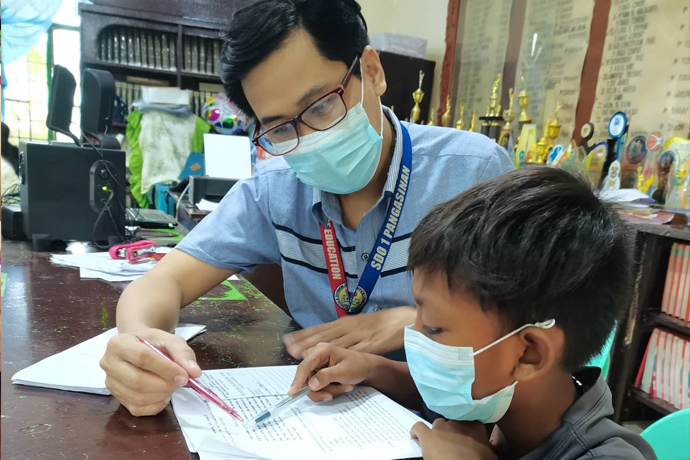

BSP, DepEd, and BDO Foundation push for wider use of financial literacy tools

Teachers across the country are encouraged to integrate financial literacy in their lessons by utilizing free and ready to use teaching resources developed through the collaboration of the Bangko Sentral ng Pilipinas (BSP), Department of Education (DepEd) and BDO Foundation.

15 Jul 2025 | 2 min read

Turning crisis into opportunity

Ma. Florencita Cansino, a Davao-based entrepreneur and founder of Hyatt Diagnostics System, Inc. was accustomed to providing diagnostics services for Filipinos heading overseas for employment. But when the pandemic struck, business operations halted, leaving her in a challenging position.

15 Jul 2025 | 1 min read

BDO shortens offer period for fourth ASEAN Sustainability Bond issue

BDO Unibank, Inc. (“BDO” or the “Bank”) disclosed that it has shortened the offer period for its fourth Peso-denominated ASEAN Sustainability Bonds issue. Originally set to run from July 9 to 22, 2025, the Bank decided to close the offer period early, on July 14, 2025, following strong demand from both retail and institutional investors.

14 Jul 2025 | 2 min read

Cash Agad turns local stores into financial lifelines

Micro, Small, and Medium Enterprises (MSMEs) play an important role in the Philippine economy, and their impact continues to grow. Beyond providing essential goods, many MSMEs now serve as vital banking access points for rural communities, especially in remote areas.

14 Jul 2025 | 2 min read

BDO supports Mactan Rock for sustainable clean water access

Ensuring reliable access to clean water continues to be a development priority in several provinces and cities across Visayas and Mindanao. Factors such as climate variability, rapid urbanization and ecological changes have impacted natural water sources, underscoring the need for sustainable water management solutions to support communities and local economic activities.

11 Jul 2025 | 2 min read

When the ‘universe’ aligns, great banking happens

It was love at first tap for Miss Universe 2015 Pia Wurtzbach when she discovered the BDO Universal Teller Machine. “Honestly, BDO continues to surprise me, even after all these years,” says the global personality hailed for her modeling career, lifestyle choices, and meaningful advocacies.

10 Jul 2025 | 2 min read

BDO Foundation prioritizes access to basic healthcare

Several primary care facilities in the provinces of Antique and Cebu received renovation support from BDO Foundation through the recommendation of BDO and BDO Network Bank branches. As part of its long-standing program, the foundation continues its mission to support public health workers and local government units in providing optimal patient care within an environment that is conducive to healing and wellness.

09 Jul 2025 | 2 min read

BDO launches fourth ASEAN Sustainability Bond issue

BDO Unibank, Inc. (“BDO” or the “Bank”) is set to issue Peso-denominated Fixed-Rate Sustainability Bonds with a minimum aggregate issue size of PHP5 billion. This marks the Bank’s fourth Peso-denominated Sustainability Bond following a PHP 55.7 billion issue in July 2024, PHP63.3 billion issue in January 2024, and PHP52.7 billion issue in January 2022.

07 Jul 2025 | 2 min read

Now Belle Mariano can leave her wallet at home, thanks to BDO Pay

Backstage during her shoot as the face of BDO Pay, Belle Mariano confessed: She often leaves her wallet in her house or car. As someone with a packed schedule (performances and projects left and right), Belle tends to forget that detail, but couldn’t be bothered with the hassle of digital payments, like cashing in. Who has the time and energy?

04 Jul 2025 | 3 min read

Donate to save endangered species in PH from extinction

Only in the Philippines can you find some of nature’s most majestic and enthralling animals: the mighty Philippine eagle, the musical Philippine cockatoo, the gentle pawikan, the resilient tamaraw, the curious dugong, and the quiet Philippine pangolin. More than symbols of our heritage, these creatures are guardians of the ecosystem, playing a crucial role in protecting the country’s ecological balance. However, time is ticking: these critically endangered animals could become extinct soon.

27 Jun 2025 | 2 min read

Scan, send, pay with BDO Pay—like Belle Mariano

Gen Z star Belle Mariano is sharing a money slay tip to her millions of followers across TikTok, Instagram, X, and Facebook. Most recently, Belle revealed she is a BDO Pay user for her everyday payments.

27 Jun 2025 | 2 min read

BDO is PH’s most valuable brand for second consecutive year

With its continued focus on enhancing customer experience, promoting financial inclusion, and driving operational excellence, BDO Unibank Inc. (BDO) has once again been recognized as the country’s most valuable brand for the second straight year by Brand Finance, the world’s leading brand valuation consultancy.

26 Jun 2025 | 2 min read

BDO backs ACEN in clean energy milestone

BDO Unibank Inc. (BDO) has partnered with ACEN, the Ayala group’s listed energy platform, to finance ACEN’s Onshore Wind Power Project—set to become the largest wind power facility in the Philippines.

24 Jun 2025 | 1 min read

BDO's Nestor V. Tan is 1st Filipino president of the IMC

Nestor V. Tan, President and CEO of BDO Unibank Inc. (BDO), has recently been elected as President of the International Monetary Conference (IMC) for the 2025–2026 term. The election took place during the IMC’s annual gathering held in Brussels, Belgium.

19 Jun 2025 | 2 min read

All those years Dad put us first, now it's his turn

Growing up, most kids have memories of asking their dads for their school allowance or pocket money when going out with friends. As most fathers are the breadwinners, they are affectionately called the family’s ‘bank’ where members come for ‘withdrawals.’

17 Jun 2025 | 3 min read

Say goodbye to cash-in and fees with BDO Pay

Are you paying too many cash-in fees? Paying for bills plus convenience charges? Do you wish you could use your debit or credit card for shopping even if you’ve left the physical plastic at home?

13 Jun 2025 | 3 min read

BDO powers the PH by financing the world’s largest solar power plant

In line with its commitment to sustainable development, BDO Unibank, Inc. (BDO) supports the financing of MTerra Solar, the world’s largest integrated solar and battery storage facility. This milestone project, aimed to address the country’s growing power supply demand, is expected to provide clean energy to approximately 2.4 million households.

04 Jun 2025 | 3 min read

BDO Foundation: Improving health care for Filipinos

Crowded waiting areas, worn down buildings, and poorly ventilated consultation rooms are what one would witness when visiting the old La Libertad Primary Care Facility (PCF). “The paint was peeling and the whole space felt like it was no longer conducive to healing and recovery,” shared Eleanor Acabo, branch head of BDO Network Bank Negros Oriental-Guihulngan branch, as she described her visit to their local health center.

22 May 2025 | 4 min read

Deals that take you places: Get onboard, The Great BDO Travel Sale is back!

This is every BDO Cardholder's chance to catch up on their travel plans for the year and beyond. The Great BDO Travel Sale will once again open its doors to enthusiastic globetrotters nationwide.

22 May 2025 | 2 min read

For the Moms we love, let us count the ways BDO helps them grow their money

Being a mom is being the CEO of your home, also known as the Chief Expense Officer. From groceries to utilities to tuition fees to insurance premiums, you are responsible for a spending list that seems to go on and on.

20 May 2025 | 2 min read

BDO Foundation and the SEC: Helping Filipinos spot investment scams

When an investment opportunity sounds too good to be true, it’s probably a scam. Unfortunately, it can be difficult to identify legitimate opportunities versus bogus ones as scams become more and more sophisticated each day.

19 May 2025 | 4 min read

Investment banking in the digital age: Navigating the future of capital markets

The investment banking industry is undergoing a gradual but impactful transformation. What was once a highly manual, paper-driven process characterized by chalkboards, floor runners, and physical coupons for interest payments has given way to a fully digital ecosystem. Technology has redefined how capital is raised, trades are executed, and information is consumed, placing unprecedented power in the hands of both issuers and investors.

15 May 2025 | 2 min read

French Trade Minister and Officials meet BDO Executives to deepen partnership

His Excellency Laurent Saint-Martin, French Minister Delegate for Foreign Trade and French Nationals Abroad, and Her Excellency French Ambassador Marie Fontanel, recently visited BDO and met with Chairperson Teresita Sy-Coson along with Romeo R. M. Co, Jr., Senior Vice President and Department Head of Financial Institutions and International Desks, and Marie Antoinette Mariano, First Vice President and Head of Europe and North America Desks.

14 May 2025 | 1 min read

BDO wins 6th Platinum Reader’s Digest Trusted Brand Award

Jean L. Avendaño (left), BDO Unibank’s First Vice President and Head of Cards Business Growth of Consumer Banking Group, accepts BDO’s 6th consecutive Platinum Award under the Bank category from Sheron White, Retail and Sales Advertising Director of Reader’s Digest for Asia Pacific, at the 27th Reader's Digest Trusted Brands Awards.

13 May 2025 | 1 min read

Pregnant mothers receive special care in RHUs rehabilitated by BDO Foundation

Many of the more than 210 health facilities across the country rehabilitated by BDO Foundation house birthing clinics that address the needs of pregnant mothers. One such facility is CHO Panganakan ng San Jose in Nueva Ecija, which was recently renovated by the foundation as part of continuing efforts to help improve the healthcare delivery system in the country.

09 May 2025 | 3 min read

A soldier's daughter learns the value of money at 7

Major Maria Theresa Babiera of the Philippine Army is one of the many beneficiaries of BDO Foundation. As the corporate social responsibility arm of BDO Unibank, the Foundation partners with several government agencies, including the Armed Forces of the Philippines (AFP) and the Bangko Sentral ng Pilipinas (BSP) to promote financial inclusion in the country.

07 May 2025 | 3 min read

BDO boosts the power sector with support for Casecnan Hydroelectric Plant

In a move to strengthen the country’s clean energy future, BDO Unibank, Inc. (BDO) supports Fresh River Lakes Corporation (FRLC), a subsidiary of First Gen Corporation, in the acquisition of the 165-megawatt (MW) Casecnan Hydroelectric Power Plant.

06 May 2025 | 2 min read

BDO subsidiary reports ₱36.5 million income in 1Q 2025

Dominion Holdings, Inc. (DHI, formerly BOO Leasing and Finance, Inc.) reported a net income of ₱36.5 million in the first quarter of 2025, compared to the ₱75.9 million earnings in the same period in 2024.

06 May 2025 | 2 min read

A traveler’s guide to affordable and fun adventures

Going on vacations is one of life’s greatest joys—from exploring new destinations, experiencing different cultures, to creating unforgettable memories with friends and family. It should not be derailed by unexpected mishaps and last-minute changes.

02 May 2025 | 3 min read

For life’s uncertainties, we all need a Plan B

In a recent market survey, only 5 out of every 10 breadwinners in the National Capital Region, Cebu and Davao consider life insurance as important. More alarming is the declining sense of urgency post-pandemic. A 2022 survey had 83% saying owning protection is important, yet that figure dropped to 54% in 2024.

01 May 2025 | 3 min read

Mortuary service provider secures seamless operations with BDO

For siblings Angel and Ancel Brillantes, the mortuary business has always been familiar territory. Growing up with their father’s enterprise since the ‘70s, they never shied away from its realities. Today, they continue to lead Angel B. Brillantes Jr. Funeral Homes, Inc. as one of the mortuary service providers in Davao.

29 Apr 2025 | 2 min read

Bank your way with BDO’s Universal Teller Machine

You think certain bank transactions can only be done at the counter? Not anymore! With BDO’s Universal Teller Machine (UTM), everyday banking has become simpler and more convenient—giving you more ways to choose how you bank.

28 Apr 2025 | 3 min read

BDO Network Bank brings simple, practical banking closer to communities

BDO Network Bank (BDONB), the community banking arm of BDO Unibank, continues to bring practical banking solutions to underserved areas—particularly in far-flung communities where access remains a challenge.

25 Apr 2025 | 2 min read

BDO earns ₱19.7 billion in Q1 2025

BDO Unibank, Inc. (BDO) recorded a net income of ₱19.7 billion in Q1 2025, vs. ₱18.5 billion for the comparable period a year ago, driven by sustained performance across its core businesses. Return on Average Common Equity (ROCE) was at 13.8% for the period.

16 Apr 2025 | 2 min read

BDO supports Bohol-based company in advancing sustainable water solutions

Water scarcity is a pressing issue for Bohol residents as many communities face limited access to potable and steady water. Bohol island has to depend on groundwater sources or water sourced underground, which has led to saltwater intrusion and contamination, endangering public health and contributing to the spread of waterborne illnesses such as diarrhea.

15 Apr 2025 | 1 min read

Dine out with up to 55% off—only with BDO Pay!

Dining out is much more delicious with a discount—especially if it’s up to 55% off! All you have to do is pay the bill with your BDO Credit Card through BDO Pay.

14 Apr 2025 | 2 min read

BDO subsidiary’s income at ₱202 million in 2024

Dominion Holdings, Inc. (formerly BDO Leasing and Finance, Inc.) announced at its Annual Stockholders’ Meeting that its net earnings settled at ₱202 million in 2024, compared to ₱277 million in 2023.

14 Apr 2025 | 2 min read

BDO helps strengthen energy security in the Visayas

With a flourishing economy and rapid business growth in the Visayas region, the power consumption increases driving a greater demand for a stable and sustainable energy supply. Recognizing the vital role of reliable energy infrastructure to foster economic progress, BDO Unibank Inc. (BDO) provides financial support to Cebu-based KEPCO SPC Power Corporation (KSPC), benefiting companies, households and communities.

04 Apr 2025 | 2 min read

BDO Capital marks 25 years of supporting businesses and PH economy

As BDO Capital & Investment Corporation (BDO Capital) celebrates its 25th anniversary, its focus remains on driving business growth, generating employment, and contributing to the country’s economic progress. From a small player to becoming a leading investment bank, BDO Capital continues to help in shaping the Philippine financial landscape, enabling enterprises to expand and thrive.

03 Apr 2025 | 2 min read

BDO and PEZA forge partnership to attract global investments

BDO Unibank Inc. (BDO) signed a Memorandum of Understanding (MoU) with the Philippine Economic Zone Authority (PEZA), reinforcing their shared commitment to accelerating foreign investments and economic growth in the country.

02 Apr 2025 | 1 min read

Celebrating women empowerment in the workplace

BDO Unibank, Inc. shares invaluable lessons on leadership and financial empowerment at this year’s She Talks Asia Summit. Marla Garin-Alvarez, BDO Unibank Vice President and Head of Sustainability Office highlights the importance of women taking charge of their futures—whether through representation in leadership, access to financial resources, or financial literacy.

31 Mar 2025 | 2 min read

BDO powers electric mobility, strengthens commitment to green transport

In supporting businesses that embrace eco-friendly practices, BDO Unibank Inc. (BDO) plays a vital role in driving economic progress while advancing sustainability. As part of this commitment, BDO financed the acquisition of Mober’s 60 electric vehicle (EV) trucks enabling the company to expand its operations as a pioneer in green logistics.

24 Mar 2025 | 2 min read

BDO backs NAIA modernization to boost air mobility

Recognizing the vital role of infrastructure in national progress, BDO Unibank Inc. (BDO) remains committed to supporting projects that help advance essential services and drive sustainable growth. Through its participation in the Ninoy Aquino International Airport (NAIA) modernization, BDO continues to be a strong partner in transforming the Philippines’ primary gateway, enhancing connectivity and economic opportunities in the country.

21 Mar 2025 | 2 min read

Family emergency fund: Save now and get an extra layer of protection

Think about your family's future. What do you see? Perhaps it's your child graduating with flying colors from a top university, your dream business finally opening its doors, or the love of your life walking down the aisle. Whatever your dreams or aspirations are, it is essential to work on your family’s future with a sound financial plan, starting with a family emergency fund.

18 Mar 2025 | 2 min read

BDO Foundation reaches 200th RHU milestone

To give more Filipinos access to primary health care services—this is a commitment that BDO Foundation continues to uphold as one of its core advocacies. Over the past years, the organization has been rehabilitating rural health units (RHUs) nationwide, and recently, it reached its 200th rehabilitated RHU as it turned over the newly renovated Rural Health Unit of San Jose in Camarines Sur—a major milestone for the foundation.

07 Mar 2025 | 2 min read

Embracing one’s golden years with confidence

One meaningful way to ensure elders feel valued and secure is through comprehensive medical insurance coverage. This allows them to continue enjoying life without the constant worry of healthcare costs. BDO Insure’s GoldCare Plan offers this peace of mind and much more.

07 Mar 2025 | 1 min read

BDO Foundation and Institute for Solidarity in Asia forge partnership

BDO Foundation signed a partnership agreement with the Institute for Solidarity in Asia (ISA), formalizing its support for the implementation of the Performance Governance System (PGS) for two provincial governments and five schools divisions of the Department of Education (DepEd).

05 Mar 2025 | 2 min read

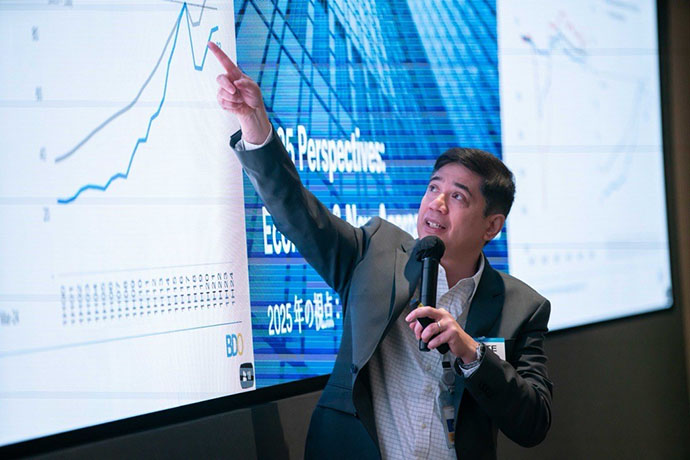

BDO’s market outlook highlights PH Growth and prime investment opportunities

At BDO’s market outlook for corporate clients, Eduardo V. Francisco, President of BDO Capital affirmed that the Philippines is well-positioned for growth, citing its resilience and vast investment potential in an evolving global economy.

04 Mar 2025 | 1 min read

Mandaluyong commends BDO Unibank for outstanding tax contributions

The City Government of Mandaluyong City has recognized BDO Unibank as one of the top taxpayers in the city, honoring the Bank's continuing commitment to promoting excellence and corporate social responsibility.

28 Feb 2025 | 3 min read

Fast at secure remittance, handog ng BDO-Seven Bank partnership

Bilib ang mga Overseas Filipinos sa malakas na partnership ng BDO Unibank, Inc. at Seven Bank ng Japan, dahil mas pinabilis nito ang pag-remit ng pera sa Pilipinas. Kasama na dito sina Arianne Matucading at Den Mojica, na naka-experience ng magandang service ng dalawang bangko.

28 Feb 2025 | 3 min read

Women MSMEs turn livelihood programs into ‘Automated Tao Machines’

A group of resilient mothers from a remote mining community in Surigao del Norte turned their livelihood programs into a channel that brings banking services closer to the community. Through BDO Unibank's agency banking channel, Cash Agad, they proved that women can inspire and lead change even in the most remote areas.

27 Feb 2025 | 2 min read

BDO and Shizuoka Bank expand partnership to boost trade and investment

With the Philippine economy’s projected growth, BDO Unibank Inc. (BDO) continues to drive national progress by expanding opportunities for Japanese companies in the country. To reinforce its partnership, BDO and Shizuoka Bank Ltd. signed a comprehensive memorandum of understanding (MOU) to enhance the business alliance and support Japanese firms in the Philippines’ competitively diverse markets.

24 Feb 2025 | 2 min read

BDO elevates digital banking with new online platform

BDO Unibank has launched the new BDO Online website, offering customers a seamless, secure, and efficient digital banking experience. With the growing reliance on digital solutions for financial management, the enhanced platform ensures that BDO customers can access their accounts, cards, and essential banking services anytime, anywhere.

24 Feb 2025 | 2 min read

BDO net income hits ₱82 billion in 2024

BDO Unibank, Inc. (BDO) recorded a net income of ₱82.0 billion in 2024, up by 12% year-on-year (YoY) from ₱73.4 billion in 2023 due to solid performance across core businesses. This translates to a Return on Average Common Equity (ROCE) of 15.14% for the year.

24 Feb 2025 | 2 min read

BDO subsidiary records ₱202 million income in 2024

Dominion Holdings, Inc. (DHI, formerly BDO Leasing and Finance, Inc.) posted net earnings of ₱202 million in 2024 as against ₱277 million in 2023.

17 Feb 2025 | 2 min read

UNICEF Philippines and BDO Foundation partner for Bangsamoro youth

UNICEF Philippines and BDO Foundation are partnering to expand educational opportunities for out-of-school children, youth, and adolescents in the Bangsamoro Autonomous Region in Muslim Mindanao (BARMM) through the Alternative Learning System (ALS). This initiative, which is set to benefit vulnerable populations in Basilan, Tawi-Tawi, and Maguindanao, will offer a second chance for out-of-school children and youth to reintegrate into formal education or develop essential employable skills.

14 Feb 2025 | 3 min read

Strong partnership ensures swift and secure remittance for Overseas Filipinos

Overseas Filipinos in Japan continue to favor the strong alliance between two trusted banks for safe and real-time money transfers. Such is the experience of Arianne Matucading and Den Mojica, who have benefited firsthand from the ease and security of BDO Unibank, Inc. and Japan’s Seven Bank in facilitating fast and reliable remittances.

10 Feb 2025 | 2 min read

Travel the world with the new BDO Visa Signature

BDO Unibank, Inc. and VISA launched the BDO Visa Signature in the Philippines through an exclusive cocktail event held at Grand Hyatt Manila. Guests were delighted with the new Travel Rebate Credit Card that boasts of 3% travel rebate on overseas and airline spends, and 0.3% on everything else, up to P2,500 rebate per month.

06 Feb 2025 | 3 min read

Remittance partnership of BDO and Japan’s Seven Bank grows from strength to strength

When sending cash to their families back home, Overseas Filipinos in Japan largely look for convenience and reliability. On these two fronts, BDO Unibank, Inc. (BDO) and Seven Bank recently renewed their commitment to continuously satisfy loyal Kabayans as well as attract new ones to their growing platform.

04 Feb 2025 | 2 min read

BDO Foundation welcomes 2025 with 4 newly rehabilitated RHUs

BDO Foundation, the corporate social responsibility arm of BDO Unibank, welcomed the new year with the turn over of four newly rehabilitated rural health units (RHUs) for the benefit of more than 96,000 Filipinos in several parts of Luzon and the Visayas.

30 Jan 2025 | 2 min read

Supporting Key Industries: BDO showcases use of proceeds in the 2nd ASEAN Sustainability Bond Impact Report

BDO Unibank Inc. (BDO) released its second ASEAN Sustainability Bond Impact Report, highlighting the full allocation of its first ASEAN Sustainability Bond (ASB) in January 2022 that generated Php52.7 billion from retail and institutional investors. The report details how the Bank allocated the bond proceeds to projects that address environmental and social challenges, following eligible categories under its comprehensive Sustainable Finance Framework.

27 Jan 2025 | 3 min read

Start saving today to secure your child’s future

Turn small savings into building blocks for your child’s bright future today. With BDO Junior Savers Account, you can begin teaching your child from a young age the value of saving with their very own account.

22 Jan 2025 | 2 min read

BDO strengthens opportunities for Japanese companies in the PH

As the Philippine economy is poised for growth, BDO fuels national development by providing essential support to Japanese businesses looking to establish or expand their presence in the country.

22 Jan 2025 | 2 min read

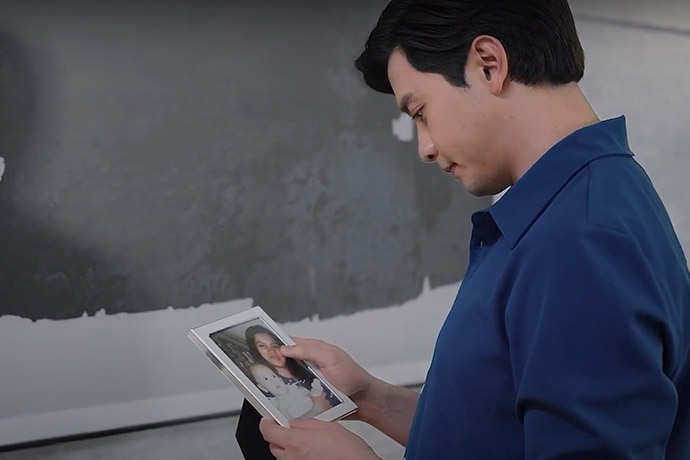

Alden Richards: His untold “Plan B” story

"It happened when I was in high school. Mama got sick. Just like that, she was gone," actor and BDO brand ambassador Alden Richards sadly recalled. "My world suddenly stopped. Our savings were quickly depleted. I had to quit school to help my family earn a living."

08 Jan 2025 | 3 min read

PH economy resilient and set for growth amid challenges, says BDO Analyst

The Philippine economy stands out as a global outperformer, bolstered by robust domestic consumption and a favorable demographic profile. Despite facing global headwinds, the nation continues to demonstrate remarkable resilience and growth potential. Dante Tinga Jr., Senior Vice President at BDO Unibank’s Investor Relations Group, highlighted this optimistic outlook during an exclusive economic briefing for BDO’s Japanese clients.

06 Jan 2025 | 1 min read

BDO Credit Cards are now on BDO Pay!

Now, BDO Pay allows you to simplify your transactions while still earning numerous discounts and promos. The BDO Pay app puts all your cards in one place, allowing you to link and choose what BDO credit or bank account to use for seamless payments—without the need to carry the physical cards. You can also view your credit card details and transactions, including those of supplementary cards, right on the app.

26 Dec 2024 | 1 min read

'Tis the season of giving: 50,000 families receive noche buena packs from BDO Foundation

Christmas comes alive in simple acts of kindness, generosity and bayanihan. In celebration of the season, BDO Foundation distributed gift packs to 50,000 families nationwide in line with its annual Handog Sa ’Yo ng BDO Foundation Christmas gift-giving initiative.

20 Dec 2024 | 2 min read

BDO Foundation rehabilitates several RHUs in Bohol province to cap 2024

In line with its advocacy to enable rural health units (RHUs) across the country to deliver better primary health care services, BDO Foundation turned over five rehabilitated health centers in Bohol for the benefit of more than 100,000 Boholanos.

20 Dec 2024 | 2 min read

A gift that grows a lifetime: Teach your kids financial freedom this Christmas

Christmas is a season for giving, and every parent wants to make it magical for their kids. This year, instead of gifting them with toys or gadgets that could bring momentary joy, why not give them something that will last a lifetime?

13 Dec 2024 | 2 min read

BDO Foundation, TESDA, and BSP unveil online fin ed modules

BDO Foundation, the Bangko Sentral ng Pilipinas (BSP), and the Technical Education and Skills Development Authority (TESDA) recently launched free online financial education (fin ed) modules for the benefit of millions of technical-vocational learners nationwide. Co-developed by BDO Foundation and the BSP, these modules are now available to the public through the TESDA Online Program at e-tesda.gov.ph.

12 Dec 2024 | 3 min read

Public school teachers benefit from continued support from DepEd and BDONB in reaching their financial goals

Public school teachers stand to benefit from the continued support from the Department of Education (DepEd) and BDO Network Bank (BDONB), particularly in equipping them with financial knowledge to help them achieve their personal goals.

09 Dec 2024 | 1 min read

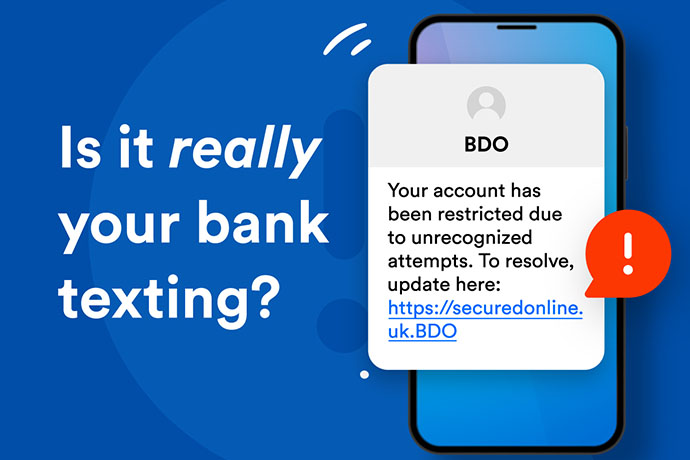

Banking public warned against prevalence of text or SMS hijacking scam

The banking public should be wary against the prevalence of text or SMS hijacking, a type of scam wherein fraudsters impersonate legitimate SMS senders to dupe recipients into believing that the messages they receive are authentic.

09 Dec 2024 | 3 min read

A partner for every Negrense

BDO Unibank’s wide footprint in Bacolod and Negros Occidental ensures that people can easily access its wide range of products—whether it’s for their personal savings, loans, investments, or businesses—tailored to each customer’s unique needs, wherever they may be in their financial journey.

05 Dec 2024 | 2 min read

Enjoy the latest deals this Christmas on BDO Pay

'Tis the season to be shopping to avoid the Christmas rush! Thanks to the convenience of shopping totally cashless and cardless through the BDO Pay app, shopping for Christmas gifts will have a different kind of rush, not the frenetic kind.

04 Dec 2024 | 4 min read

BDO’s cash management becomes tool for financial inclusion

A number of small and medium enterprises (SMEs) in Negros Occidental will soon be able to utilize BDO Unibank's cash management services (CMS) not only to efficiently manage their cashflow, but also to serve as an important financial inclusion tool for their own employees.

28 Nov 2024 | 3 min read

Ex-PBB housemate appreciative of opportunity to share financial knowledge during BDO Fiesta

Former Pinoy Big Brother (PBB) housemate Bryan "Brx" Ruiz expressed his appreciation for being given the opportunity to share his financial knowledge to fellow Negrenses during the recent BDO mini-fiesta held at the Sipalay City Gymnasium.

25 Nov 2024 | 2 min read

BDO Fiesta well-received in Bacolod

BDO Unibank celebrated its own BDO Fiesta by bringing joy and financial knowledge to the very people it serves, through different products and services that benefit individuals, families, businesses, and communities. Following the success of the BDO Fiesta in the Ilocos province, BDO went to Bacolod to promote Tara na sa BDO! Sa bangko, sigurado.

15 Nov 2024 | 3 min read

The Rise of the New BDO Corporate Center Makati

BDO Chairperson Teresita Sy-Coson and BDO President and CEO Nestor V. Tan led a time capsule-laying ceremony on November 15, 2024, marking the commencement of construction of the new BDO Corporate Center Makati.

13 Nov 2024 | 3 min read

BDO, nagbabala laban sa mga ‘vishing’ scam

Patuloy na pinag-iingat ang publiko laban sa tinatawag na "vishing" o voice phishing scam na kadalasang tumatarget ng mga bank depositor o online bank account client para nakawin ang kanilang pinaghirapang pera.

12 Nov 2024 | 3 min read

BDO Capital sees opportunities in growing PH energy investments

During the 19th Philippine Summit hosted by The Asset, BDO Capital & Investment Corporation President Eduardo F. Francisco emphasized the immense potential of the Philippine economy to grow through strategic investments in infrastructure, particularly in the energy sector.

07 Nov 2024 | 2 min read

BDO subsidiary's 9M 2024 net earnings at ₱171 million

Dominion Holdings, Inc. (DHI, formerly BDO Leasing and Finance, Inc.) recorded a net income of ₱171 million in the first nine months of 2024 compared to ₱205 million in the comparable period in 2023.

04 Nov 2024 | 2 min read

BDO clinches 5 Golden Arrow Award

BDO Unibank Inc. (BDO) received the prestigious 5 Golden Arrow recognition, the highest award for Corporate Governance from the Institute of Corporate Directors (ICD) at the ASEAN Corporate Governance Scorecard (ACGS) Golden Arrow Awards 2024.

31 Oct 2024 | 2 min read

BSP and BDO Foundation conduct fin ed training for Odiongan LGU

BDO Foundation and the Bangko Sentral ng Pilipinas (BSP) partnered with various local government units (LGUs) to implement initiatives aimed at improving the financial literacy of local government personnel and their constituents.

28 Oct 2024 | 2 min read

BDO posts ₱60.6 billion net income in 9M 2024

BDO Unibank, Inc.’s (BDO) net profit grew 12% year-on-year (YoY) to ₱60.6 billion in the first nine months of 2024, driven by the sustained contribution of its core intermediation and fee-based service businesses. Annualized Return on Common Equity (ROCE) stood at 15% in the 9M 2024 period.

26 Oct 2024 | 3 min read

A story of service and resiliency: BDO remains online amidst the onslaught of Typhoon Kristine

In the face of great damage brought by Tropical Storm Kristine to the Bicol Region, BDO Unibank remained online within the Rinconada District to serve the community’s cash requirements at a dire time when people needed access to their funds.

18 Oct 2024 | 1 min read

No cash? No problem, with Scan to Pay feature of BDO Pay

Cashless payments for groceries and other essentials have never been easier and quicker with the Scan to Pay feature of BDO Pay. It can be linked to your BDO savings account or credit card so there’s no need to load the app or e-wallet, just start shopping!

16 Oct 2024 | 2 min read

Education beyond the classroom: Teachers learn FinLit lessons in session organized by BDO Foundation

A teacher’s influence extends beyond the four walls of the classroom. Recognizing the role of teachers in guiding the youth, the Department of Education (DepEd) and BDO Foundation organized a financial literacy session for the benefit of 20 teachers from Naga, 20 teachers from Iriga, and 60 teachers and nonteaching personnel from Camarines Sur in commemoration of this year’s National Teachers’ Month. This was hosted by Schools Division Office - Camarines Sur.

14 Oct 2024 | 3 min read

BDO, Asia’s premier banks release new report to support climate transition

BDO Unibank Inc. (BDO), along with leading Asian banks, has published the Asia Transition Finance Annual Report 2024 to help Asian economies achieve a “just and orderly transition” toward a more sustainable future.

08 Oct 2024 | 3 min read

BDO, DTI partnership set to make PH a smart and sustainable manufacturing hub in SEA

BDO Unibank, Inc. (BDO) has partnered with the Department of Trade and Industry (DTI) to strengthen the flow of foreign investments into the Philippines.

04 Oct 2024 | 2 min read

BDO empowers women employees, breaks gender barriers in leadership

At BDO, women make up 75% of total workforce and 58% of senior management. To empower all employees, particularly women, to reach new heights in their careers, BDO offers skills enhancement programs, with female employees representing 65% of participants in the management development program and an impressive 88% in the officer development program.

02 Oct 2024 | 2 min read

BDO drives expansion of PH’s top hospital for better healthcare

BDO Unibank, Inc. (BDO) provided financial support to The Medical City (TMC) enabling it to extend its healthcare services to more Filipinos. This funding was essential in ensuring the hospital’s continued operations and navigate the financial challenges posed by the pandemic. The unprecedented surge of patients during the COVID-19 crisis strained healthcare facilities. This experience strengthened TMC’s commitment to broaden its services and address the diverse healthcare needs of the community.

01 Oct 2024 | 3 min read

BDO partners with DMW in helping OFWs achieve financial freedom

The Department of Migrant Workers (DMW) has partnered with private sector companies like BDO Unibank in helping overseas Filipino Workers (OFWs) achieve financial freedom through the successful launch of the Balik Kabayan Bazaar, a livelihood fair aimed at supporting OFWs who have returned back to the country to pursue entrepreneurship.

29 Jul 2024 | 2 min read

BDO 1H 2024 income reaches ₱39.4 billion

BDO Unibank, Inc. (BDO) posted net earnings of ₱39.4 billion in the first half of 2024, 12% higher year-on-year, on the stronger momentum from its core intermediation and fee-based service businesses. Annualized Return on Common Equity (ROCE) improved from 14.3% in the first quarter to 15.8% in the second quarter.

12 Aug 2024 | 2 min read

Alden Richards finds an ideal partner in BDO

Alden Richards has been a BDO Unibank client for almost a decade. This year, he became the bank’s newest brand ambassador.

13 Aug 2024 | 2 min read

200 market vendors graduate from FinLit program by BDO Foundation and Iloilo City LGU

Two hundred market vendors in Iloilo City have completed the financial literacy training provided by the BDO Foundation in collaboration with the Iloilo City Local Government Unit (LGU). This initiative aims to empower local entrepreneurs with the essential knowledge and skills to manage their finances effectively and sustainably.

12 Aug 2024 | 3 min read

BDO backs sustainable and responsible growth for PH conglomerates

BDO Unibank, Inc. (BDO) actively partners with leading Philippine conglomerates like San Miguel Corporation (SMC) to promote growth that benefits the economy, society, and environment.

02 Aug 2024 | 2 min read

BDO's new hotline, now easier for clients' recall

Clients can now get banking support anytime and anywhere in the Philippines through BDO Unibank’s new 24/7 hotline number: (+632) 8888-0000.

25 Oct 2023 | 2 min read

BDO reports 9M 2023 net income of ₱53.9 billion

BDO Unibank, Inc. (BDO) reported a net income of ₱53.9 billion for the 9M 2023 vs. P40.0 billion in 9M 2022, backed by broad-based growth across its core businesses. This resulted in a Return on Common Equity (ROCE) of 15.1% compared to 12.4% in the same period last year.

24 Jun 2024 | 1 min read

Official statement regarding recent passbook incident

Please be informed that in the recent passbook incident as narrated by Mr. Gleen Canete in his social media account, BDO has been able to account for the withdrawals that caused stress to Mr. Canete. All withdrawals done by the accountholder online were verified to be valid. Mr. Canete advised BDO that they will resolve matters within their family. BDO always looks after the security of its clients and encourages them to maintain privacy of their accounts.

.png)

21 Jun 2024 | 1 min read

Statement on alleged cybercrime affecting BDO and other banks

BDO assures its customers that there has been no compromise of any of their information in the Bank. BDO continues its practice of proactively working with concerned agencies in a concerted effort to protect consumers from any form of cybercrime.

10 Aug 2023 | 2 min read

BDO fosters sustainability in the workplace

The collective efforts of 300 BDO Unibank employees who participated in two coastal clean-up activities resulted in the collection of more than 2,200 kilos of waste from the Las Piñas-Paranaque Critical Habitat and Ecotourism Area (LPPCHEA), a protected area that is home to 41 species of migratory birds and one of the few remaining mangrove forests in Metro Manila.

14 Sep 2023 | 2 min read

BDO Insure: For the love and paw-tection of furbabies

BDO Insure, SM Super Pets Club, and Pioneer Insurance embarked on the Super Pets Club Caravan across various SM Malls from August 12 to September 3, 2023.

10 Aug 2023 | 2 min read

Caring for pets can be costly, but it’s always worth it

Only devoted and loving fur parents can truly know the value of caring for a pet—and only they can understand how the unconditional love of their fur babies improves their mental and physical health and their overall quality of life.

27 Sep 2023 | 2 min read

BDO enhances banking experience through digital innovations in branches

BDO Unibank continues to enhance the banking experience of its clients by integrating digital innovations in its branches.

10 Aug 2023 | 2 min read

BDO subsidiary’s 1H 2023 net profit at P125.3 million

Dominion Holdings, Inc. (formerly BDO Leasing & Finance, Inc. or BLFI) reported net earnings of ₱125.3 million in 1H 2023 as against ₱3.7 million in 1H 2022. Gross income increased more than six-fold to ₱162.3 million as the firm reallocated its funds to higher yielding investments and debt securities to capitalize on the prevailing attractive interest rates.

11 Aug 2023 | 2 min read

BDO reiterates support on transition to sustainable energy

BDO Unibank, Inc. (BDO) has expressed its support to the Department of Energy’s (DOE) efforts to increase energy generation and address the ever-increasing demand for electricity and minimize its environmental impact by promoting renewable sources of energy.

12 Oct 2023 | 2 min read

BDO Foundation and LINK join forces to support MSMEs

As part of a shared advocacy to support aspiring and existing micro-entrepreneurs, and enable them to pursue business ventures that are responsive to current challenges, BDO Foundation recently forged a partnership with LINK Center for the Deaf for a training initiative aimed at enhancing the capabilities of micro-small and medium-sized enterprises (MSMEs).

04 Sep 2023 | 2 min read

BDO wins the Sustainable Finance Initiative of the Year

BDO Unibank Inc. (BDO) received the Sustainable Finance Initiative of the Year Award at the 2023 Asian Banking & Finance Wholesale Banking Awards in Singapore. BDO’s unwavering commitment to Sustainable Finance was recognized as the Bank financed groundbreaking renewable energy projects, pioneered innovative funding channels, forged sustainable partnerships with international financial institutions, and integrated Environmental, Social and Governance (ESG) in funding projects.

29 Aug 2023 | 2 min read

BDO drives greater sustainable finance

BDO Unibank, Inc. (BDO) continues to strengthen its commitment to a sustainable future through proactively financing energy efficiency projects, including green facilities and vehicles.

25 Sep 2023 | 2 min read

BDO, top Asian banks publish new report on climate initiatives

BDO Unibank Inc. (BDO), along with leading Asian banks, has released the Asia Transition Finance Annual Report 2023 to help Asian economies achieve a “just and orderly transition” toward a more sustainable future.

03 Apr 2023 | 2 min read

BDO partners with Japan’s Hyakujushi Bank

BDO Unibank Inc. (BDO) signed a business alliance agreement through a memorandum of understanding (MOU) with The Hyakujushi Bank Ltd. (HBL), a leading regional bank based in Kagawa Prefecture. With 132 branches including satellite offices and commercial banking services, HBL is the 16th Japanese bank which has partnered with BDO.

16 Aug 2023 | 2 min read

BDONB: Now ready to serve Cauayan, Negros Occidental

BDO Network Bank opened its first branch in Cauayan, Negros Occidental to serve individuals and micro, small, and medium-sized enterprises (MSMEs) looking for a partner in progress.

17 Oct 2023 | 2 min read

BDO bolsters traditional and digital banking services

BDO Unibank said its 1,200 branches nationwide now have self-service onboarding kiosks, making it easy for clients to open accounts and transact in the branches. Several branches also have a universal machine where clients can do various transactions, including cash and check deposits, fund transfers, pay bills, and update their passbooks.

11 Oct 2023 | 2 min read

BDO & BDONB empower Eastern Visayas with relevant financial solutions

BDO Unibank and its community banking arm BDO Network Bank continue to empower the provinces of Leyte, Samar, and Biliran by providing relevant financial solutions to address their residents’ and businesses’ unique banking needs.

12 Sep 2023 | 2 min read

BDO joins Department of Education’s Brigada Eskwela

BDO Unibank Inc. (BDO) participated in the Department of Education’s (DepEd) Brigada Eskwela 2023, a nationwide school maintenance program which encourages local governments, communities, businesses, non-governmental organizations and individuals to help in the public school clean-up before the opening of classes.

12 Oct 2023 | 2 min read

BDO Foundation receives recognition for empowering Filipino fishers

Touted as one of the most outstanding in Asia, a corporate citizenship initiative of BDO Foundation aimed at securing the financial well-being of Filipino fishers clinched four prestigious accolades.

29 Nov 2023 | 2 min read

Top 3 tips to protect yourself from bank scams

BDO Unibank advises its customers not to fall for tricks of scammers, no matter how “urgent” the messages may look and how “legitimate” the scammers may sound.

04 Aug 2023 | 2 min read

BDO expands footprint in Lucena

Residents and visitors of Lucena City, Quezon can now easily and conveniently do their bank transactions at the newly-opened BDO branch in their area.

21 Jul 2023 | 2 min read

Want to succeed in life? Coco Martin shares three important tips

How did Coco Martin, a well-known actor, director, and now brand ambassador of BDO Network Bank, succeed in life?

31 Jul 2023 | 2 min read

BDO 1H 2023 net income reaches ₱35.2 billion

BDO Unibank, Inc. (BDO) posted earnings of ₱35.2 billion for the 1H 2023, driven by broad-based growth across its core businesses. This translated to a Return on Common Equity of 15.1% compared to 11.3% in the comparable period last year.

11 Aug 2023 | 2 min read

BDO & BDONB offer relevant banking solutions to Palawan communities

BDO Unibank and its community banking arm BDO Network Bank significantly impacted Palawan province when they recently held their on-the-ground banking activities and empowered communities and businesses with relevant banking solutions.

06 Nov 2023 | 2 min read

BDO is PH’s Best Service Provider in Cash Management

BDO Unibank Inc. (BDO) was named as the country’s Best Service Provider in Cash Management for the 5th consecutive year at The Asset Triple A Treasurise Awards 2023 in Hong Kong. BDO was given this recognition due to the Bank’s continued focus on understanding client needs and developing effective and innovative solutions.

16 Nov 2023 | 2 min read

BDO enhances sustainability commitment through tree planting

BDO Unibank Inc. (BDO) supported ABS CBN Foundation’s “Bantay Kalikasan” (Nature Watch) which aims to protect and enrich our country’s environment by collaborating with various sectors of the community.

16 Nov 2023 | 2 min read

BDOF completes rehab of rural health units in Bohol and Cebu

BDO Foundation (BDOF) has completed the rehabilitation of the Getafe Rural Health Unit (RHU) in Bohol, its 150th since it started to embark on improving healthcare infrastructure and access in different underserved communities of the country in 2012.

10 Aug 2023 | 2 min read

BDO subsidiary’s 1H 2023 net profit at P125.3 million

Dominion Holdings, Inc. (formerly BDO Leasing & Finance, Inc. or BLFI) reported net earnings of ₱125.3 million in 1H 2023 as against ₱3.7 million in 1H 2022. Gross income increased more than six-fold to ₱162.3 million as the firm reallocated its funds to higher yielding investments and debt securities to capitalize on the prevailing attractive interest rates.

24 Oct 2023 | 2 min read

BDO helps drive economic growth in the PH

BDO Unibank Inc. (BDO) supports investments in infrastructure and transportation projects such as airports and road networks which are requisites to accelerate economic trade and activities.

02 Oct 2023 | 2 min read

Arsenio’s Plan B: A solution to uncertainty after death

Arsenio was living a life that many Filipinos dream of—working as a successful professional in the Middle East. But like many other Overseas Filipino Workers (OFWs), he constantly missed his wife and children. So, with his finances permitting, he relocated his family so they could be together.

23 Aug 2023 | 2 min read

Dispelling myths: Stay the course in the bourse during Ghost Month

BDO Securities encourages investors to maintain a steadfast approach to their investment strategies and not be swayed by superstitions as the “Ghost Month” approaches.

15 Sep 2023 | 2 min read

From dreams to legacy: The inspiring story of a son’s plan B

Born and raised in a humble fishing village, Jerome's fascination with the sea began at a young age. Spending countless afternoons by the shore, he would dream of exploring the world beyond the small island he called home. He witnessed how hard his parents worked to make ends meet; his father was a fisherman while his mother sold the day’s catch in the local market. Jerome was determined to chart his own course and provide for their needs.

10 Aug 2023 | 2 min read

BDO fosters sustainability in the workplace

The collective efforts of 300 BDO Unibank employees who participated in two coastal clean-up activities resulted in the collection of more than 2,200 kilos of waste from the Las Piñas-Paranaque Critical Habitat and Ecotourism Area (LPPCHEA), a protected area that is home to 41 species of migratory birds and one of the few remaining mangrove forests in Metro Manila.

08 Aug 2023 | 2 min read

BDONB’s financial wellness training, a big help to Bataan

Teachers and micro-entrepreneurs in the towns of Balanga, Dinalupihan, and Morong in Bataan have gained more knowledge on financial management through the community day and financial wellness trainings conducted by BDO Network Bank.

18 Oct 2022 | 2 min read

Life insurance is a selfless act of love

Why does life insurance matter? Renato Vergel De Dios, President and CEO of BDO Life, offers an insight that quite interestingly, people don’t hear every day: “Life insurance is a lasting and selfless expression of love.”

11 Feb 2022 | 2 min read

Digitalization: Why naysayers are right—and wrong

BDO Unibank’s Senior Vice-President and Head of Cash Management Services Carlo Nazareno spoke at the European-PH Business Summit and shared his insights and experiences in how digital and online technology developed and transformed the Philippine banking industry.

14 Sep 2021 | 2 min read

How your kids’ allowance can help secure their future

Giving children an allowance is a good opportunity for them to learn about proper money management. A study published in the Journal of Economic Psychology suggested that kids who received an allowance spent less and had better money management skills than those who did not. This shows that the best way to teach kids about finances is to give them an opportunity to handle their own.

28 Feb 2022 | 2 min read

Big Pizza: How Shakey’s and BDO play top game in fast-food

It’s a pizza lover’s truism: the secret to yumminess is in the sauce. But the whole truth is not so simplistic. The secret sauce to the delicious success of Shakey’s Pizza, one of the Philippines’ most beloved brands, has quite a few special ingredients. Read on and find out.

23 May 2023 | 2 min read

BDO combines the strengths of physical and digital banking

Digitalization has resulted to significant changes in various industries, allowing businesses to operate more efficiently and interact with customers with greater responsiveness. Banks, in particular, have been able to leverage new digital technologies to transform their services and offer customers the ability to make financial transactions with just a few taps on their devices.

19 Oct 2021 | 2 min read

BDO’s sustainability efforts include support to MSMEs

While most people have adjusted to the new normal, many are still hoping for things to go back to the way they were. Ernesto Abad, a micro enterprise owner from Los Baños, Laguna, is one of those hoping that his poultry feeds store recovers, after almost shutting down when the pandemic hit.

13 Oct 2021 | 2 min read

Teach kids how to save by example and participation

Work-From-Home parents have rediscovered the joys of family togetherness during the pandemic—this is a special silver lining if there ever was one. As we continue to hunker down and stay safe by following health protocols, we rediscover that time with our family—especially the kids—is an opportunity to bond, have fun, and even learn together.

11 Apr 2022 | 2 min read

Do you have an emergency fund? Know why it’s important

When COVID-19 virus started to spread in the Philippines, those who got infected were caught unprepared for the cost of treatment because they do not have an emergency fund. What is emergency fund and why is it important to have one?

22 Mar 2022 | 2 min read

BDO Foundation: Finding ways for financial inclusion

For more than three years now, BDO Foundation, the corporate social responsibility arm of BDO Unibank, has been implementing financial education programs, making significant strides in efforts to contribute to the development of a financially literate citizenry.

03 May 2023 | 2 min read

BDO Life: A love that protects after tragedy strikes

It’s devastating when a family member passes away. But beyond the pain of grief and loss is another tragedy if a family is not financially prepared. Family members who are left behind face loss of income and as a result, financial uncertainty and a drastic, unwelcome change in their lifestyle.

20 Aug 2021 | 2 min read

Leave your child true riches

Without a doubt, education is the best legacy parents can leave their children. This doesn’t only mean sending them to the best schools but also teaching them the necessary life skills to survive.

13 Jun 2022 | 2 min read

Filipino families with uninsured breadwinners at risk

According to Swiss research firm Swiss Re Institute, 75% of families in developing countries like the Philippines are vulnerable to both emotional devastation and loss of income when a family breadwinner or income earner passes away. This is identified as the mortality protection gap.

08 Nov 2022 | 2 min read

Micro-businesses in Zamboanga recover amid tough times

As the local economy reopens in Zamboanga, many micro and small business owners were provided opportunities to recover their businesses. For most MSMEs, additional funding is needed to help resume business operations which were momentarily suspended. Lizaruth Morales, a micro-business owner from Saavedra, Zamboanga was one of them.

23 Sep 2022 | 2 min read

Online stock trading made easy with BDO Securities

Investors who want to benefit from investment opportunities look for ease and convenience when choosing an online trading platform, and that is exactly what BDO Securities brings to the table. BDO Securities’ most distinctive competitive advantage lies in the company’s ability to provide fast, easy, and accessible investment solutions to its valued clients.

25 Mar 2021 | 2 min read

Expats say thanks to their bank heroes

Lives would be more stressful, difficult, inconvenient, and less secure if not for Filipino frontliners’ commitment to their duties as we all struggle with the pandemic. These include bank employees who help clients access cash for our basic needs.

08 Nov 2022 | 2 min read

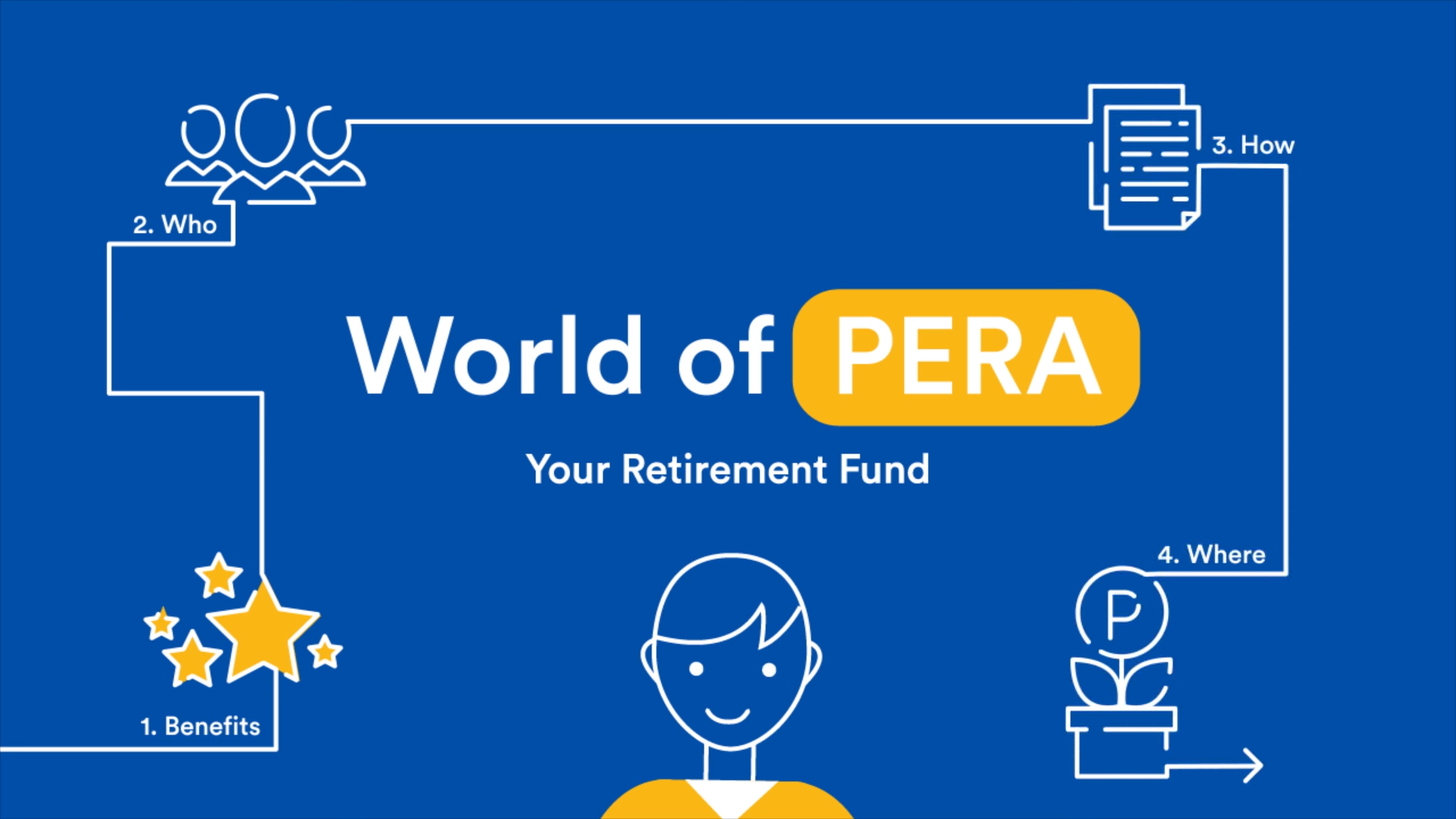

Better-off retirement with PERA

Most Filipinos remain unresponsive to retirement planning even when its importance has been highlighted, time and again, by experts. The lack or insufficient understanding of its benefits remains the primary reason, followed by personal choices, life situations and mindsets.

30 Jul 2021 | 2 min read

A winning recipe for burgers and business

For the family of Joseph and Vicky Mojica, there is nothing sweeter than being able to run a business in the Philippines. The couple owns the popular Angel’s Burger food kiosk that has more than a thousand outlets all over the country.

23 Nov 2021 | 2 min read

Fight the money taboo to protect your financial future

It is often considered rude or embarrassing to speak openly about money matters. Local and international articles and financial experts have discussed this “money taboo” and found the main reasons behind this dilemma.

14 Mar 2023 | 2 min read

Technically speaking, trend is your friend

For an investment instrument as volatile as stocks, is it still possible to predict how stock prices will move at a given time?

04 Aug 2021 | 2 min read

Yes, you can have money talks with your preschoolers

If you are hesitant about discussing money matters with your child, relax. Experts say that letting your kids participate in these discussions—and even in decision-making—is beneficial to them.

04 Oct 2022 | 2 min read

Finding ways to bring learning closer to students

Being a teacher is not just about teaching. It's about inspiring, encouraging, and supporting the students. But it's not every day you see a teacher go out of their way to reach out to students and parents.

11 Jul 2023 | 2 min read

Fur baby love: In sickness and in health

Filipinos love their dogs and cats now more than ever. The numbers even bear this out. Here are a few interesting facts about Filipino fur parents and their fur babies, according to the Fédération Cynologique Internationale:

06 Apr 2022 | 2 min read

Planting seeds, harvesting progress

East-West Seed (EWS) is a global seed company that develops, produces, and markets hybrid tropical vegetable seeds to some 20 million smallholder farmers worldwide. Founded in 1982 in Lipa City, Batangas, Dutch seedsman Simon Groot and Filipino seed trader Benito Domingo had a vision to improve the income of smallholder farmers in the tropics through its high-quality seeds. But just like a seed that began seeking fertile ground to thrive in, EWS struggled at first to gain the confidence of the Filipino farmers.

01 Jul 2021 | 2 min read

Six tips to outsmart debit/credit card scams from BDO

Scams are becoming increasingly “authentic” and “sophisticated”. But there are ways to spot and outsmart them. BDO Unibank enumerates six useful tips to keep the clients safe when making transactions using their debit and credit cards:

13 Oct 2021 | 2 min read

Needs vs. Wants: Teachable moments at home

Now that parents and children are having online classes or working from home, it’s for their benefit to find and make the most of teachable moments during the day. One of the basic life lessons that a child must learn is correct money management.

28 Jan 2022 | 2 min read

Stirring businesses with digital advantage

One of the major challenges faced by businesses at the start of the pandemic was the disruption in cash flow. It lasted for months due to lockdowns and social distancing regulations.

02 Dec 2021 | 2 min read

Cash Agad: Bridging the country’s financial divide

As many Filipinos remain underbanked and the Philippines continues to lag behind its ASEAN neighbors in terms of automated teller machine (ATM) rollout, there are financial institutions that find ways to bridge this financial gap through innovative means.

03 Nov 2022 | 2 min read

To novice investors: Buy blue chip stocks at low valuations

Dropping share prices might keep a lot of investors in the sidelines these days, but for stock market beginners, now is actually a good time to seriously consider buying stocks.

07 Jan 2022 | 2 min read

BDO Network Bank backs MSMEs as drivers of economic growth

Micro-SMEs (MSMEs) remain the country’s economic growth engines albeit the challenges that confront their businesses due to the pandemic. For this reason, BDO Network Bank (BDONB) ensures they get the needed support to make their operations and processes efficient and robust.

31 Jan 2022 | 2 min read

Secure your child’s future through budgeting and saving

From saving to thoughtful spending to budgeting and living within the means, these are the basic financial skills that one should learn even at a young age. Yes, kids need to learn these, too, not only to help them have a secure future but to also give them the confidence to deal with and understand financial problems.

20 Jun 2022 | 2 min read

Bakit mahalaga na nasa bangko ang ipon

Maraming pinoy pa rin ang hindi nakasanayan ang pag-iipon sa bangko. Kadalasan, nagdadalawang-isip sila na pumasok sa bangko sa paniniwalang maraming requirements at mataas ang initial deposit. Habang ang iba naman ay kuntento nang nakatago sa bahay ang kanilang ipon na pera para “easy access” kapag may biglaang gastusin.

29 Jun 2022 | 2 min read

BDO integrates benefits of digital to branch banking

Local businesses are turning to self-service technologies to provide safer and more efficient ways for customers to accomplish their daily transactions.

19 May 2023 | 2 min read

BDO to young professionals: Start saving for retirement

Retirement may be the last thing on the minds of the young and employed. However, BDO Unibank advises them to start saving for it already to secure a more comfortable post-employment life.

10 Mar 2022 | 2 min read

Five lessons from a valuable partnership

Still going strong and riding on a wave of campus expansion across the country is one of the oldest universities in the Philippines: National University (NU). NU already has nine branches to date.

05 Jan 2023 | 2 min read

Is there a golden rule in stock market investing?

With inflation rate not yet showing signs of slowing down, is there a golden rule that stock market investors should follow to keep their investments at bay?

04 Oct 2023 | 2 min read

Coco’s advice: Find a reliable business partner

BDO Network Bank brand ambassador and Batang Quiapo star Coco Martin said giving a 100% commitment and focus to running a business is essential.

18 Oct 2022 | 2 min read

Ipon tips para sa hirap mag-budget

Sa panahon ngayon na ramdam ang bigat na dala ng mataas na presyo ng mga basic goods, rent at electricity bills, paano kakayanin ang pagba-budget sa araw-araw at patuloy na maka-ipon kahit konting halaga?

21 Nov 2021 | 2 min read

BDO Network Bank, all out support to small business owners

Arlene Gener, a former Overseas Filipino (OF) in Dubai, decided to return home to look after her children. She used her hard-earned savings as capital to start a rice retailing business—but the COVID-19 pandemic affected her monthly sales.

21 Jun 2022 | 2 min read

Philippines gears up to become a cashless society

A cashless society is one where cash is not the primary mode for financial transactions. Instead, transactions are settled electronically using credit or debit cards, mobile or online payment apps and even QR codes.

18 Jul 2023 | 2 min read

Single mom's love and foresight saves daughters after COVID-19 tragedy

Cathy Santos, a courageous single mother, and small business owner, took decisive action to protect her daughters' future amidst the ongoing COVID-19 pandemic. Her story is a testament to the power of love and thoughtful financial planning in the face of adversity.

07 May 2021 | 2 mins read

Tuloy-tuloy ang pag-alalay ng BDO sa MSMEs

Todo ang suporta ng BDO Unibank sa financial inclusion o ang programang pinangungunahan ng Bangko Sentral ng Pilipinas na naglalayong ilapit ang konsepto ng pagbabangko sa mga Pilipinong naninirahan sa mga lugar na malayo sa syudad.

09 Feb 2022 | 2 min read

BDO Foundation completes relief ops in Odette-hit areas

Despite the limited mobility caused by the recent surge in COVID-19 cases, BDO Foundation, the corporate social responsibility arm of BDO Unibank, has completed relief operations in nine provinces hit hardest by Typhoon Odette, one of the most destructive storms to make landfall in the Philippines in recent years.

03 Dec 2019 | 2 min read

Mindanaoans receive aid from BDO volunteers