Corporate Profile

BDO is a full-service universal bank in the Philippines, providing a complete array of industry-leading products and services including Lending (corporate and consumer), Deposit-taking, Foreign Exchange, Brokering, Trust and Investments, Credit Cards, Retail Cash Cards, Corporate Cash Management and Remittances. Through its local subsidiaries, the Bank offers Investment Banking, Private Banking, Leasing and Finance, Rural Banking and Microfinance, Life Insurance, Property and Casualty Insurance Brokerage, and Online and Traditional Stock Brokerage services.

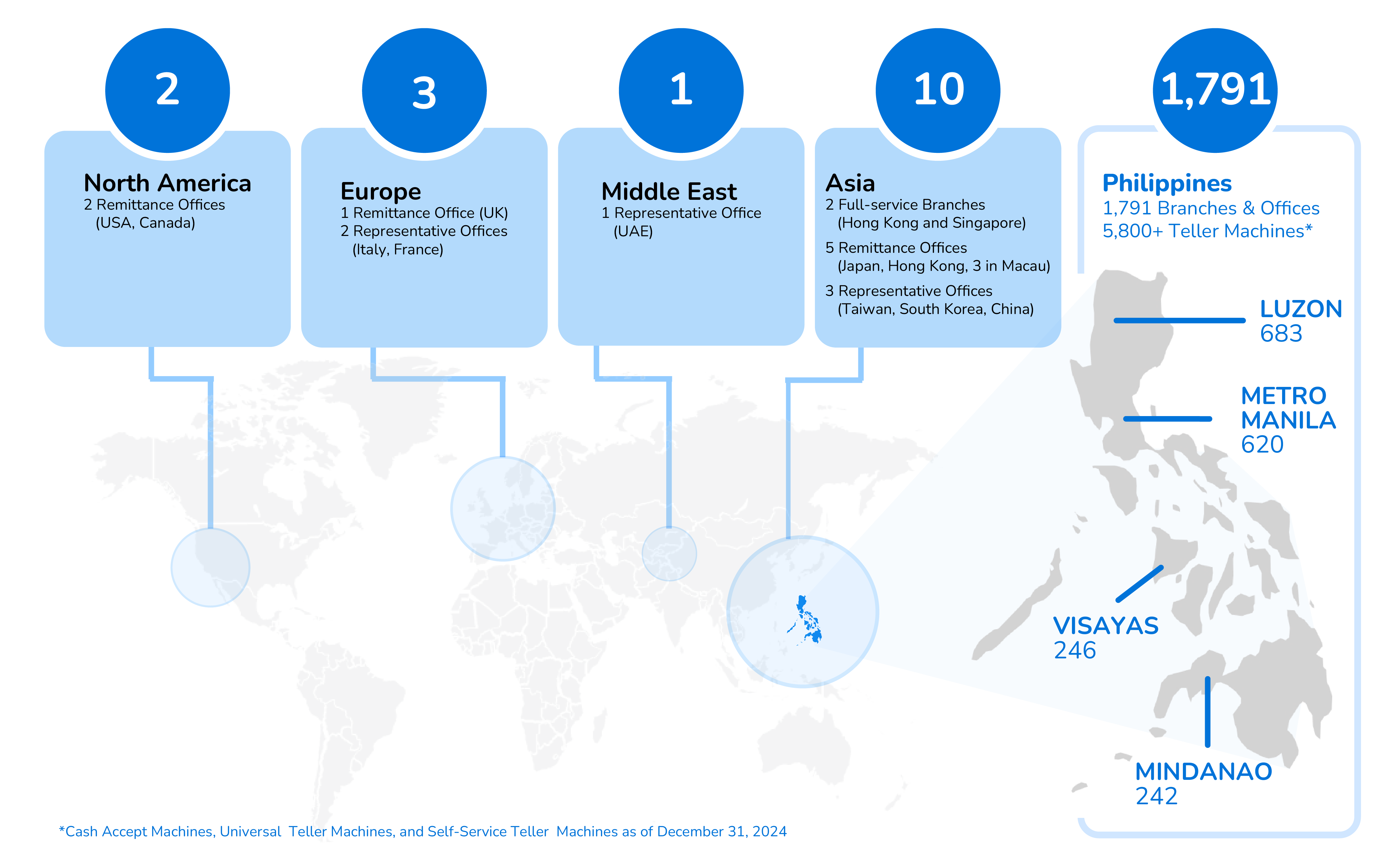

BDO’s institutional strengths and value-added products and services hold the key to its successful business relationships with customers. On the front line, its branches remain at the forefront of setting high standards as a sales and service-oriented, customer-focused force. The Bank has the largest distribution network with over 1,700 operating branches and more than 5,800 teller machines nationwide. BDO has 16 international offices (including full-service branches in Hong Kong and Singapore) spread across Asia, Europe, North America, and the Middle East.

The Bank also offers digital banking solutions to make banking easier, faster, and more secure for its clients.

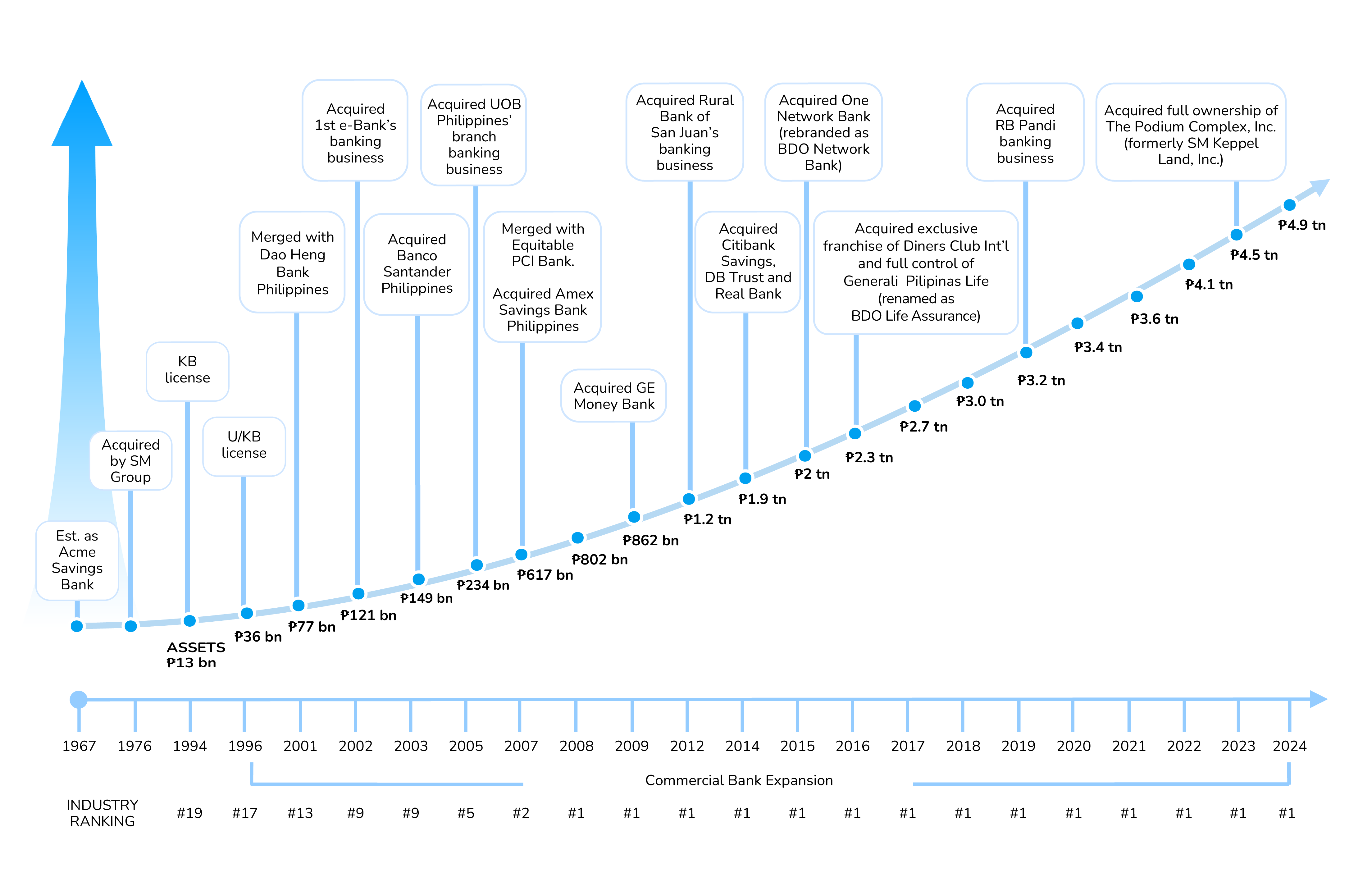

Through selective acquisitions and organic growth, BDO has positioned itself for increased balance sheet strength and continuing expansion into new markets. As of December 31, 2024, BDO is the country’s largest bank in terms of total resources, customer loans, deposits, assets under management and capital, as well as branch and teller machine network nationwide.

BDO is a member of the SM Group, one of the country’s largest and most successful conglomerates with businesses spanning retail, mall operations, property development (residential, commercial, hotels and resorts), and financial services. Although part of a conglomerate, BDO’s day-to-day operations are handled by a team of professional managers and bank officers. Further, the Bank has one of the industry’s strongest Board of Directors, composed of professionals with extensive experience in various fields that include banking and finance, accounting, law, and business.

Core Values

Commitment to Customers

We are committed to deliver products and services that surpass customer expectations in value and every aspect of customer services, while remaining to be prudent and trustworthy stewards of their wealth.

Commitment to a Dynamic and Efficient Organization

We are committed to creating an organization that is flexible, responds, to change and encourages innovation and creativity. We are committed to the process of continuous improvement in everything we do.

Commitment to Employees

We are committed to our employees’ growth and development and we will nurture them in an environment where excellence, integrity, teamwork, professionalism and performance are valued above all else.

Commitment to Shareholders

We are committed to provide our shareholders with superior returns over the long term.

Milestones

Expansion through organic growth and M&As

Market Reach

Wide and extensive coverage in key areas

(As of December 31, 2024)