Frequently Asked Questions (FAQs)

Find the answers to a wide range of questions about trading, navigating our platform, as well as account-related concerns.

(Note: To sign up for BDO Securities, you must first have the BDO Online App installed on your phone.)

- Download the BDO Online App on your mobile device through the app store (Android Play Store or iOS App Store)

- Open the BDO Online App

- Click "Sign up"

- Select "Savings or Checking account"

- Provide the details required. Agree to both the Terms & Condition and Data Privacy Consent after reviewing. Once done click "Next"

- Create your BDO Online log in credentials. Make sure to follow the password format as indicated. Click "Submit"

*Password made in the BDO Online app will not reflect in the BDO Online Banking website.

Use your BDO Online App username and password to log in to BDO Securities and access your account.

*Password made in the BDO Online app will not reflect in the BDO Online Banking website.

- You are not a minor

- You must have a valid Taxpayer Identification Number (TIN)

- You are not applying under a Sole Proprietorship account

- You have a valid and existing BDO Savings or Current Account

- You have an active BDO Online App account

- BDO Pay Account

- SSS Pensioner Account

- Joint AND Account

- In-Trust For Account

To unlock your BDO Securities Online Trading account, please reset your password using the BDO Online Mobile App. Follow the applicable steps below:

If you are new to the BDO Online Mobile App:

1. Click on "Need help logging in."

2. Select "I'd like to reset my password."

3. Enter your Username and the last 4 digits of your account.

4. Create your new password.

If you have existing access to the BDO Online Mobile App:

1. Click "Log in."

2. Click "Forgot PIN?"

3. Click on "Need help logging in."

4. Select "I'd like to reset my password."

5. Enter your Username and the last 4 digits of your account.

6. Create your new password.

If you are encountering issues with registration or resetting your password in the BDO Online Mobile App, please contact the Online Banking Team at (+632) 8888-0000 or send an email to callcenter@bdo.com.ph.

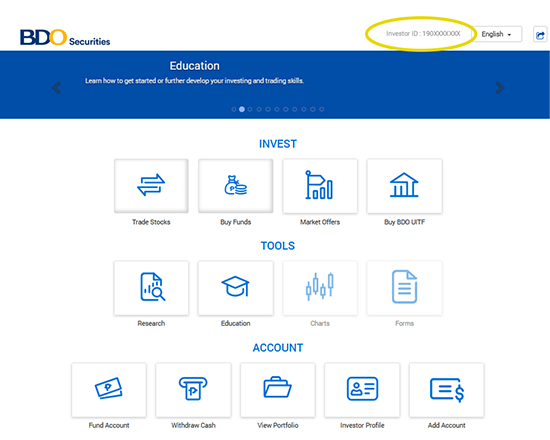

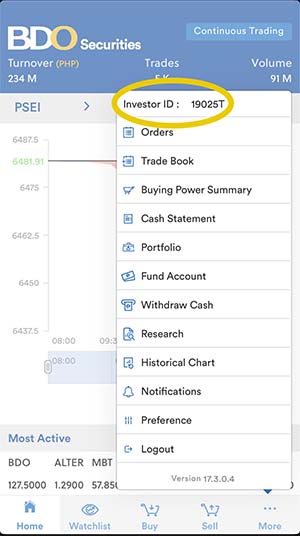

The Customer Code refers to the Investor ID that you will find on any of the following:

- BDO Securities Online Platform Landing Page listed as "Investor ID"

- BDO Securities Mobile App 'More' menu button listed as “Investor ID”

- Account Opening Email Confirmation

- Statement of Accounts

- Trade Confirmation

- Log in to your BDO Online Mobile App

- Once you’re logged in, tap More, then Update Profile

- Tap the arrow beside your mobile number

- Enter your new mobile number, then tap Update

- Enter the One-Time PIN (OTP) sent to your registered email address to confirm your account

- You will get acknowledged when the mobile number is successfully updated.

*Mobile number update made in the BDO Online app will not reflect in the old BDO Online Banking website.

Accounts without any cash flows (either deposits or withdrawals) for two (2) years will be placed in the inactive list. This will require you to visit your BDO branch of account to reactivate. If you have further questions, please call the BDO Hotline at +63 28631-8000.

For overseas customers who cannot physically go to the branch of account, please send an email to bdosec-customercare@bdo.com.ph.

You can prevent account dormancy by making either a deposit or withdrawal on your account at least once every two (2) years.

- Customer Code

- Full name

- Date

- Check the box "Change in Nominated Beneficiary Account".

- On the "From" field, indicate your current BDO Securities Beneficiary account.

- On the "To" field, indicate your NEW BDO Securities Beneficiary account.

- If the new beneficiary account is with a different Branch of account, please check the box provided for "Closure of BDO Securities Corporation Settlement Account due to any of the following > Change in Beneficiary Account under a different Branch of Account"

Log in to your online trading account and click "Fund Account".

Deposited amount is credited automatically to your BDO Securities settlement account.

***Please be informed that you will not be able to access the Deposit function from 11:45pm until 2:30am (Philippines GMT+8), Mondays to Fridays, due to daily system maintenance.

Log in to your online trading account and click “Withdraw Funds”. Withdrawn amount is credited automatically to your Beneficiary Account.

Important note on T+2: Proceeds from the sale of any stock will have a two-business day clearing from the date of sale before it becomes available for withdrawal.

To illustrate, if you sold your shares on a Monday then the proceeds will be available for withdrawal on Wednesday.

Your cash dividends or selling proceeds will automatically be credited to your assigned BDO Securities Settlement Account.

What is a BDO Securities Settlement account? This is located in your BDO Securities account. To view your dividend payments: Log in to your BDO Securities Portal > Click View Portfolio > Click Transaction History Tab > Under Transaction Type click Statement of Account and included your preferred date range.

*Note that your BDO Securities Settlement Account is different than your BDO Securities Beneficiary Account. Your BDO Securities Beneficiary Account is your savings (current) account with BDO Unibank. Your BDO Securities Settlement Account is located in your BDO Securities Portal.

| Buy | Sell | |

|---|---|---|

| Securities Clearing Corporation of the Philippines (SCCP) fee | 0.010% of the gross amount | same |

| Broker’s Commission | 0.25% of the gross amount | same |

| Value Added Tax (VAT) | 12% of the broker's commission | same |

| Sales Tax | Not applicable | 0.10% of the gross selling amount |

Note: Sales Tax was 0.60% of the gross selling amount prior to the effectivity of CMEPA on July 1, 2025.

Other Fees and Charges Upliftment

Conversion of scripless stock to stock certificate ₱250.00

(additional ₱200 courier fee for provincial mailing address) Lodgment

Conversion of stock certificate to scripless (for online trading via BDO Securities Corporation) ₱100.00 per stock AND ₱20.00 cancellation fee per certificate

(additional 12% VAT for Non-bank transfer offices) Withholding Tax on cash dividends Cash dividends issued by domestic corporations:

- 10% withholding tax rate for Filipino citizens and resident aliens (foreigners residing in the Philippines)

- Non-resident aliens or foreign clients not residing in the Philippines may be subjected to a higher withholding tax rates depending on Tax Treaties existing between his/her country of residence and the Philippines.

Cash dividends issued by non - domestic corporations:

- 15% withholding rate for all clients. Transfer of Shares

Transfer of shares from other broker to BDO Securities Corporation or vice versa ₱84.00 per type of share

Example: 100 shares of BDO Unibank Inc. = ₱84.00 transfer fee All fees and charges will be debited from BDO Securities Settlement Account

- You must have an account with BDO Securities.

- You must have an NoCD account opened with BDO Securities

- Real Estate Investment Trusts (REITs)

- Dollar Denominated Securities (DDS)

If you are ELIGIBLE and interested to participate in Corporate Actions such as Initial Public Offer (IPO), Stock Rights Offer (SRO), Follow On Offer (FOO), or Tender Offer (TO), simply follow the steps below:

- Login to BDO Securities website within the prescribed period.

- Click “Market Offers” from the account dashboard.

- Select the Corporate Action event in the “Market Watch”.

- Enter the total number of shares you wish to subscribe to in the “Order Entry”.

- Review your entry, then click “Subscribe”.

Amendment and/or Cancellation of reservation must be made through the “Order Book” field in the Market Offers tab, and may be accommodated only until the stipulated BDO Securities Reservation cut-off date.

To access BDO UITFs, please log in to BDO Online Banking.

You may contact BDO Customer Contact Center:

- Email: callcenter@bdo.com.ph

- Contact Numbers: +63 2 8631 8000 and select the following options:

- Note: Press 1 for Philippine Customers, then Press 6 For Other BDO Products and Services, then choose option 4 for UITF, EIP and PERA.

- 9:00am - Pre-Open

- 9:15am - Pre-Open No Cancel

- 9:30am - Market Open

- 12:00nn - Market Recess

- 1:00pm- Market Resumption

- 2:45pm - Pre-Close

- 2:50pm - Run-Off/Trading at Last

- 3:00pm - Market Close

Yes, there is a limit to the amount you can trade. For Buying orders, you are limited to the amount available in your account balance. For Selling orders, you can only sell stocks that are in your portfolio inventory.

All Market related reports such as, Daily Digest, Weekly Wrap and Stock of the Week are being sent to client's registered email. You may also access these reports by logging in to your BDO Securities Online Account and click on "Research".

There are risks involved in investing, whether in equities or in other securities. To learn more about investing in equities, please go to our Education portal and select “Investment Education with BDO Securities”.

The lodgement process normally take at least one week to be completed. In some instances, personal appearance may be required by the transfer office. Once cleared, your stockholdings will be reflected in your portfolio.

The upliftment process normally takes at least a month to be completed. In some instances, personal appearance may be required by the transfer office. Once ready, the stock certificate/s will be delivered to your registered mailing address unless specified otherwise.

Investment Funds Basics

Mutual Funds and UITFs are pooled funds collected from multiple investors to invest in various financial securities such as stocks, bonds, and other assets. These funds are managed by professional investment managers who make investment decisions on behalf of the investors.

As an investor, your ownership is represented by the number of shares or units you hold in the fund. When share/unit prices (NAVPS or NAVPU) increase, so does your investment's value. Do take note that this type of investment also entails risk, thus it is also possible that a decrease in share/unit prices may happen.

Money Market Funds - These funds invest in short-term, low-risk securities to provide stability and liquidity. They are suitable for investors looking to preserve their capital and have easy access to their funds

Bond Funds - These funds invest in fixed-income securities such as government bonds, corporate bonds, and other debt instruments. They are suitable for investors looking for stable returns and have a lower risk tolerance

Balanced Funds - These funds invest in a mix of stocks, bonds, and other assets to provide a balanced portfolio. They are suitable for investors looking for diversification and moderate risk

Equity Funds - These funds invest in stocks or equities of companies. They are suitable for investors seeking capital growth and are willing to take on a higher level of risk

Index Funds - These funds aim to replicate the performance of a specific market index. They are passively managed and have lower fees compared to actively managed funds

Specialized Funds - These funds focus on specific investment strategies or themes, such as sustainable investing, global opportunities, or alternative assets. They are suitable for investors looking for specialized investment options

Feeder Funds - These funds must invest at least 90% of their assets in another pooled investment fund or collective investment scheme

Fund of Funds - These funds must invest at least 90% of their assets in more than one pooled investment fund or collective investment scheme

Mutual Funds and UITFs offer diversification, professional management, and access to a wide range of investment opportunities that may not be available to individual investors. They also provide liquidity, transparency, and convenience for investors looking to invest in the financial markets.

Mutual funds and UITFs charge various fees, such as management and administrative fees, all of which are disclosed in the fund's Key Information and Investment Disclosure Statement (KIIDS) or Fund Fact Sheet. Note that BDO Securities does not impose sales load and transaction fees.

Minimum initial and subsequent investment is as low as P1,000.00

You can find information on the investment strategy, underlying securities, and fund performance/returns of a Mutual Fund or UITF from the following sources:

Ready to invest in Mutual Funds and UITFs?

Log in to your online trading account and click "Fund Account".

Deposited amount is credited automatically to your BDO Securities settlement account.

***Please be informed that you will not be able to access the Deposit function from 11:45pm until 2:30am (Philippines GMT+8), Mondays to Fridays, due to daily system maintenance.

to view the fund's profile. You can review fund's Key Information and Investment Disclosure Statement (KIIDS) or Fund Fact Sheet, propectus, fund type, cut off time, days to settlement redemption, last NAV price and product risk rating.

to view the fund's profile. You can review fund's Key Information and Investment Disclosure Statement (KIIDS) or Fund Fact Sheet, propectus, fund type, cut off time, days to settlement redemption, last NAV price and product risk rating.  of the fund you want to subscribe to

of the fund you want to subscribe to of the fund you want to redeem

of the fund you want to redeem of the subscription or redemption you want modify.

of the subscription or redemption you want modify.  of the subscription or redemption you want cancel.

of the subscription or redemption you want cancel. You can view all your outstanding Mutual Funds and/or UITFs on the Holdings tab on the Buy Funds page

US persons and those residing in Russia, Syria, Iran and North Korea

Investment Funds Terminologies

Refers to the order cut off time of a specific fund. Orders received after this time will be processed on the next trading day.

Funds have different settlement redemption depending on the fund type. Each fund's settlement redemption period is displayed on the fund details screen.

- Transactions that involve collections from clients and other business partners will generate an OR.

- Transactions that involve payments to clients and other business partners will NOT generate an OR.

- Buy and Sell (Trade-Related)

- Corporate Action with cash movements

- Other Fees and Charges

- Prepayments

- Cash Dividends

- Stock Dividends

- Property Dividends

- Property Dividends without Witholding Tax (shares)

- Refunds

- Redemption or Buy Back (equities)

- Coupon Payment (funds)

With

Email Address?

|

Mode of Delivery | |

|---|---|---|

| Individual | YES | OR will be sent to the account holder’s registered email address

|

| NO | OR will be sent to the account holder’s registered physical mailing address

|

|

| Joint | YES | OR will be sent to the primary account holder or the account holder’s nominated email address

|

| NO | OR will be sent to the registered physical mailing address in the CAIF

|

|

| Corporate | YES | OR will be sent to the registered email address in the CAIF

|

| NO | OR will be sent to the registered mailing address in the CAIF

|

- For Individual Accounts - Date of birth (DOB) using the format MMDDYYYY or the alphanumeric Customer Code/ Investor ID

- For Joint Accounts - Date of birth (DOB) of the Primary Account Holder, using the format MMDDYYYY or the alphanumeric Customer Code/ Investor ID

- For Corporate Accounts– Date of Incorporation using the format MMDDYYYY or the alphanumeric Customer Code/ Investor ID

The T+2 settlement cycle refers to the timeframe within which trades executed on the Philippine Stock Exchange (PSE) must be settled. "T" stands for the trade date, while "+2" indicates that settlement will occur two trading days after the trade date.

- For BUY Transactions:

(a) Online Accounts - If your buy order executes on a Monday, the settlement of trade will be done on a Wednesday. Earmarking of funds remains to be at Trade Date.

(b) Broker-assisted Accounts - If your buy order executes on a Monday, the settlement of trade will be done on a Wednesday. Payment for the shares should be made two (2) days after.

- For SELL Transactions:

Proceeds of the sale remains to be available as ‘Buying Power’ at Trade Date, and will be available for withdrawal two (2) days after. To illustrate:

BUY / SELL Transaction

| Transaction Date | *Settlement Date | |

|---|---|---|

| T+3 | Monday | Thursday |

| T+2 | Monday | Wednesday |

*Settlement date may adjust due to holidays and non-settlement dates as may be announced by the Government, PSE, SCCP, PDTC, SEC or any regulatory body.

Yes, the proceeds will become part of your Buying Power, within the same day that the trade has been executed, and you will be able to use it to buy other securities in the market.

The settlement period allows time for various processes, such as verifying trade details and confirming the availablability of funds or securities.

Yes, the T+2 settlement period applies to all securities traded on the Philippine Stock Exchange.

Yes, there are some exceptions to the T+2 settlement period. These include public holidays, non-trading days, or extraordinary circumstances that may disrupt the regular settlement process. In such cases, the settlement period may be extended or adjusted based on the exchange's guidelines.

- Aug 23, 2023 trades - the last trade date under T+3 settlement

- Aug 24, 2023 trades - the first trade date under T+2 settlement, taking into account National Heroes’ Day on August 28.

For more detailed information about the new T+2 settlement period in the Philippine Stock Exchange, you can refer to the PSE's official website at www.edge.pse.com.ph.

A beneficiary account is the deposit account (Savings or Checking Account) where your sale of shares proceeds will be credited upon withdrawal.

A BDO Securities settlement account is an exclusive deposit account for your BDO Securities transactions that will be:

Debited for all your bought equities, along with other fees and charges

Credited for all your sales proceeds, cash dividends, and other credit balances

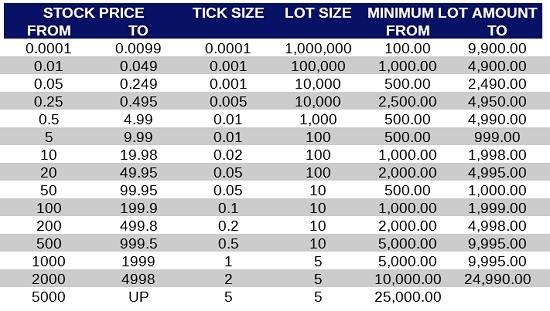

Any amount of shares wholly divisible by a minimum board lot is considered board lot.

The net amount that a client can use to buy new or additional share of stocks. This will be displayed and adjusted everytime an order is posted.

Cash that's free from any blocks or obligation against any settlement.

The price limitation set by the Exchange based on 10% below or above the last traded price.

The date set by the Exchange starting from the time when the buyer is no longer entitled to the dividends. Currently set at two (2) business days before the record date.

A securities transaction that does not settle on the contractual settlement date. Also known as failed transaction.

The lowest selling price set to not more than 30% below the last closing price. Also known as floor range.

* The low static price and floor price is now 30% below the closing price that was implemented by PSE (in 2020) the high static price remains at 50%.

A follow-on offering (FOO) is an issuance of stock shares following a company's initial public offering (IPO). The price of follow-on shares is usually at a discount to the current, closing market price.

An Initial Public Offering (IPO) refers to the process of offering shares of a corporation to the public in a new stock issuance for the first time. An IPO allows a company to raise equity capital from public investors.

A Limit Order is an order entered with a specified price and volume. Only Limit Orders are accepted by the system.

A Name on Central Depository or NoCD is a sub-account created on the client's behalf for Dollar Denominated Securities or Real Estate Investment Trust (REIT) in the NoCD facility of the Philippine Depository & Trust Corporation (PDTC) as part of the regulatory requirement.

In the case of BDO Securities, new NoCD accounts will be generated for its clients with dollar denominated accounts, as well as for REITs.

Any amount of shares not wholly divisible by a minimum board lot is considered an odd lot. (e.g. 1 share of BDO Unibank is an odd lot while 10 shares is board lot given the price of ₱132.00 per share)

Online stock trading allows you to buy and sell stocks online (using the internet) as opposed to the usual method of giving orders through telephone via an actual broker. This allows you to have real time access to the stock market.

The date when stockholders must officially own shares in order to be entitled to any shareholders rights or dividends.

The price limitation set by the Exchange based on 50% above or 30% below the last closing price.

A Stock Rights Offer (SRO) is an invitation to existing shareholders to purchase additional new shares in the company at a discount to the market price .A Stock Rights Offer is given to shareholders in proportion to their holdings.

A Tender Offer (TO) is a bid to purchase some or all of a shareholders' stock in a corporation. Tender offers are typically made publicly where shareholders are invited to sell their shares for a specified price and within a particular window of time. The price offered is usually at a premium to the market price and is often contingent upon a minimum or a maximum number of shares sold..

The allowable price range for regular buy or sell orders - from the highest buying price (ceiling) and the lowest selling price (floor) on a particular day.

The temporary stoppage or suspension of trading of a listed security, or suspension of trading in the Exchange.

The following validity types will be made available:

Day Order (Day) - Orders that remain valid until end of Trading day.

Good Till Cancelled (GTC) - Orders that will remain valid until cancelled by the user or until it reaches the set expiration date of the instrument.

Good Till Date (GTD) - Orders that remain valid until the date specified when the order is entered.

Fill-and-Kill Order (FAK) - Referred as "Execute-and-Eliminate Orders". Any remaining unexecuted portion of a FAK order is eliminated.

The circuit breaker is automatically triggered when the benchmark index, PSEi, declines by at least 10% resulting in a 15-minute trading halt of the entire market. For more details, visit www.edge.pse.com.ph.

| Circuit Breaker | Duration of Halt | |

|---|---|---|

| 1 | 10.00% | 15 minutes |

| 2 | 15.00% | 30 minutes |

| 3 | 20.00% | 60 minutes |

- All companies that belong to the following PSE Indices:

- PSEI

- MidCap Index

- DivY Index

- Exchange Traded Funds

You can go directly to either the Apple App Store or Google Play Store.

Use of the BDO Securities Mobile Trading App requires the device to be connected to the internet either via free or paid WIFI or data plan. Use of the BDO Securities App requires the device to be connected to the internet either via free or paid WIFI or data plan.

This will be available for iOS and Android smart phones and tablets.

To ensure that you are downloading the authentic application, the developer’s name appearing under the BDO Securities Mobile Trading App should be BDO Unibank, Inc. Any other name to the contrary is not an authorized version.

No. The BDO Securities App may be downloaded only once using the same device. It is however possible to reinstall an uninstalled BDO Nomura app.

No need to uninstall the original downloaded app. However, the app will prompt a message display update, and only upon confirmation will the system update push through.

- Buy

- Sell

- Monitor listed company stocks on the Philippine Stock Exchange through your mobile phone

- Monitor posted transactions

- View historical stock charts

- Fund and Withdraw from your BDO Securities account

- Access comprehensive market reports

Yes, the BDO Securities Mobile Trading App can accept multiple users in one device. A user needs to log in using his / her User ID, Password and OTP.

The User ID and Password you are currently using for BDO Online Banking will also be the same credentials to be used to log in to the BDO Securities App.

Yes, your User ID can be used among several devices which have a downloaded BDO Securities Mobile Trading App, but please take note that only one device can accommodate your User ID at a time. This means that your existing log in will be dropped if you try to access your account on another device.

Yes, similar to financial transactions performed using the BDO Securities platform, transactions such as Cash Deposit and Withdrawal are done real-time. Please take note of the clearing rule (transaction +2 trading days) if you are trying to withdraw proceeds from your selling transactions.

This is the daily system restart and maintenance of the platform scheduled from 12:00mn to 8:30am to conduct efficiency checks and performance improvement.

Contact us

BDO Corporate Center:

7899 Makati Avenue Makati City 0726, Philippines Trunkline: (+632) 8840-7000

BDO Contact Center: