In life, we all make mistakes. When it comes to investing, some beginners will take outsized risks and learn the hard way - some will take a thoughtful approach and learn the easy way. While mistakes help you learn as an investor, they can also jeopardize your investment future.

It’s important to know what not to do when you start investing - here are five common investment mistakes to avoid so you can succeed as a beginner investor.

Mistake #1 - Not understanding trading vs investing

Many new investors don’t decide their investment strategy beforehand. There are two main categories a beginner investor will fall into: trader or investor. While both trading stocks and investing in stocks are common forms of stock market investment, they differ in their execution.

A trader is an active investor who quickly buys and sells stock positions to make profits. One way a trader is successful is through a high winning ratio. A trader who is successful in earning a profit on 60% of trades will do better than a trader that’s successful with 30% of trades. The other important factor for a trader is the risk to reward ratio. If a trader buys and sells positions with a high profit potential and a low loss potential, they can average a higher return.

A long-term investor uses a different strategy than a trader. First, an investor doesn’t buy and sell stocks quickly. Rather, they buy and hold stocks for long periods of time. A long-term investor will more often use company financial information to decide if it’s a good stock to buy. This includes finding companies that will increase their profits over time and sell at a favorable stock price. A long-term investor will buy a diversified portfolio of company stocks and attempt to grow that portfolio over years.

If you begin investing without defining yourself as a long-term investor or a trader, it’s very difficult to use a defined strategy to succeed. If you decide to both trade stocks and invest for the long-term, you can separate your money into two categories and manage each portion according to your strategy.

Mistake #2 – Not having realistic expectations

Whether you’re beginning as a trader or long-term investor, you should do so with managed expectations. Many beginner traders and investors channel the stories they’ve heard of overnight wealth thanks to stocks. This is not the mindset to have when you begin investing in the stock market. No one knows what will happen in the future – a bear market could be just around the corner.

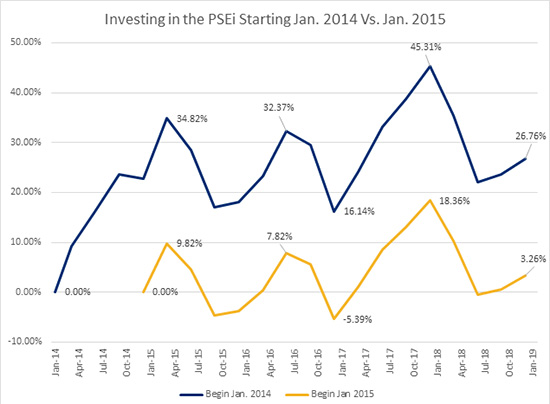

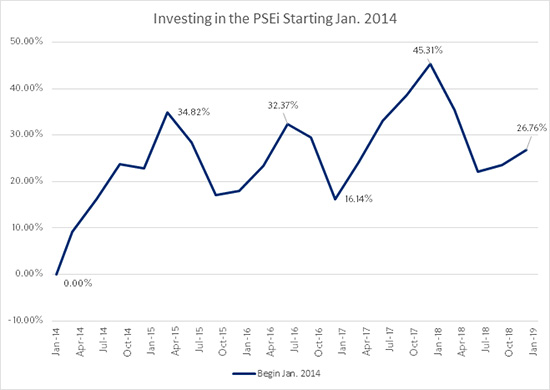

Below is a chart showing the return of someone who starts investing in the Philippine Stock Exchange Index on the first trading day of January 2014, ending on the last trading day of December 2018.

The above chart shows a return of 26.67% for anyone who invested in the Philippine Stock Exchange Index (PSEi) from January 2014 – December 2018. This averages out to an annual return of just under 5%.

Below is a chart showing investing in the PSEi starting one year later, on the first trading day of January 2015 (yellow line).

If you started investing in January 2015 instead of January 2014, you would only have a 3.26% return compared to 26.76%.

When you begin investing, you shouldn’t assume you will immediately earn large profits. Instead, you should focus on your strategy.

Mistake #3 - Not having a strategy

Whether you’re a long-term investor or a trader, having a strategy is key to your success.

Investors and traders have different strategies. Below are a couple of important strategies to remember:

Strategies for long-term investors:

Peso cost averaging

Peso cost averaging is the process of investing a set amount of money each month no matter what the market is doing. Peso cost averaging helps investors earn a higher return during bear markets and a less volatile return overall.

In the prior chart, if you had peso cost averaged in 2015 you would have had a higher return than the 3.26%.

Diversification

Diversification is the process of buying multiple stocks instead of just one stock.

It’s important to create a diversified portfolio of stocks because the stock market is impossible to predict. If you purchase one stock and the company fails or performs poorly, you could lose a lot of money. If instead, you purchase ten plus stocks and one fails or underperforms, you have nine or more stocks to rely on. Diversification spreads your investment risk

Strategies for traders:

Create a trade plan

The way you trade will be dependent on your risk tolerance, your personality, the amount you have available to invest, etc. Because every trader is different, it’s important to create a trade plan that you will stick to. A trade plan should include everything from your portfolio allocation maximum and risk per trade, to your preferred risk/reward ratio.

Winning ratio

As mentioned before, a healthy winning ratio is an important strategy for traders. Of course, it’s difficult to increase your winning ratio, but by properly planning your trading strategy and the technical indicators you follow, you can hold a steady winning ratio with a proper strategy.

A trader that takes a profit on 50% of trades will do better than a trader that takes a profit on 25% on trades, all else being equal.

Risk to reward ratio

The risk to reward ratio goes hand-in-hand with the winning ratio. If you can create a healthy winning ratio paired with a healthy risk to reward ratio, it can help you succeed as a trader. To obtain a high risk to reward ratio, you can pair trades with a high profit potential with a proper stop-loss. By limiting the amount of money you can lose while increasing the amount of money you can gain, you can create high profits through trading. Pair a high winning ratio with a high risk to reward ratio and you can succeed as a trader.

Mistake #4 - Not understanding risk

Risk is one of the most important factors to consider when trading. Everyone has a different tolerance when it comes to risk. If you’re a long-term trader and the market falls 20%, will you be able to keep cool and withstand the fall? If not, you may want to incorporate bonds into your investments through diversification.

Do you have more than a couple of stocks you’re investing in? If you’re not properly diversified, you’re taking on a lot of risk that should be spread between many different stocks, instead of just a few stocks.

If you’re a trader, are you limiting the exposure of your capital by using stop losses and a proper risk per trade? In terms of the risk per trade, many traders decide their maximum risk and will not risk more than that maximum in any one stock. For example many traders don’t risk more than 1% of their total portfolio capital on any one trade. This means you will add a stop loss and sell any position that falls more than 1% of your total portfolio (1% risk per trade) .

For example, if you have an account balance of P500,000, you won’t risk any more than a P5,000 loss on any one trade. If you purchase P100,000 of stock in Jollibee and the price of your position falls to P95,000, you will sell your position to prevent any further losses past 1% of your capital.

By limiting the percent loss of your portfolio for a trade, you prevent large losses during any one trade. Proper risk management can be the difference between success and failure in the stock market.

Mistake #5 - Not doing your research (i.e. not using BDO Securities' research)

As we’ve discussed, there is a difference between trading stocks and investing in stocks for long-term growth. No matter which investment style you use, doing proper research is hard when you’re first starting out.

Many new investors have no idea where to begin when it comes to finding stocks to buy. If you’re a long-term investor with some experience with business, finance, and accounting, you may prefer to do your own research. If you’re not experienced with these concepts, you can still utilize the research provided by BDO Securities.

Instead of combing through financial statements trying to find the intrinsic value of stocks, you can read the many reports provided by BDO Securities. These reports provide you with the opinion of the BDO Securities team of analysts. Each stock covered by the BDO Securities analysts includes a buy, sell, or neutral rating. You can use these ratings to find stocks to buy and monitor the reports, deciding when to sell current stocks and buy new ones.

If you’re a trader, BDO Securities issues a weekly report called Technically Speaking. This report can help you find trades, as well as learn about trading by keeping up with the reports each week. The report always focuses on a specific stock and provides valuable metrics such as support and resistance levels, trends, and technical indicators.

Use this report and other BDO Securities reports to help you better trade stocks.

Conclusion

Whether you’re a stock market trader or a long-term investor, many beginners make similar mistakes. Before you begin, decide if you will be a stock market trader, long-term investor, or both. Each of these has a unique execution so it’s important to decide before you start.

Make sure you have realistic expectations when you begin investing in the stock market. Starting with the mindset of overnight success can be dangerous and lead you to take extreme risks.

Start with a proper strategy - if you’re a trader, focus on your winning percentage and risk to reward ratio. If you’re a long-term investor – use strategies such as diversification and peso cost averaging.

Risk is one of the most important parts of the stock market. Traders should focus on the percent of capital they risk on each trade. By limiting the percent of capital on each trade, you can prevent large losses and outsized risk on your trades. If you’re a long-term investor you can utilize strategies such as a diversified portfolio and peso cost averaging to better manage risk.

Finally, make sure you do your research or follow the research available to you as a BDO Securities customer. By reading the reports provided by BDO Securities, you can find stocks to buy long-term and trade short-term. Use the Technically Speaking report to find trading opportunities and use the many BDO Securities research reports to find stocks with buy ratings. BDO Securities' research will help you find the right stocks to buy and prevent you from being paralyzed by the self-research learning curve. Investing in the stock market can be immensely rewarding and you need to start somewhere. While you will likely make some mistakes when you begin, try your best to avoid these five common mistakes when you start; if you do, you may very well succeed in the stock market.

_______________________________________________________________________________________

Don’t have a BDO Securities account?

Click here to open a BDO Securities brokerage account in as little as 5 minutes!

_______________________________________________________________________________________