There are different reasons companies go public, but all IPOs have one big thing in common; they go public to raise capital. Initial Public Offerings (IPOs) are how companies debut on the Philippine Stock Exchange. Prior to going IPO, companies are considered private companies, as they don’t have shares available to the general public trading on the stock market.

Many investors view IPOs as an opportunity to get in “early” and invest in a companies that may have future potential. Sometimes companies that IPO do great things, and sometimes they don’t perform very well. So, what are some factors you should look for before you invest in companies that IPO on the Philippine Stock Exchange?

Below are three tips to help you invest in IPOs in the Philippines!

Tip 1 – Decide if you will invest pre-IPO or post-IPO

There are two ways you may be able to invest in an IPO. The easiest and most common way is to invest in companies that may have future potential when it starts trading on the Philippine Stock Exchange. For example, Converge (CNVRG) went public on the PSE on October 26, 2020. You could have bought and sold shares of CNVRG through your BDO Securities online trading account on that day.

But, what if you wanted to get in on the IPO BEFORE the stock started trading on the stock market?

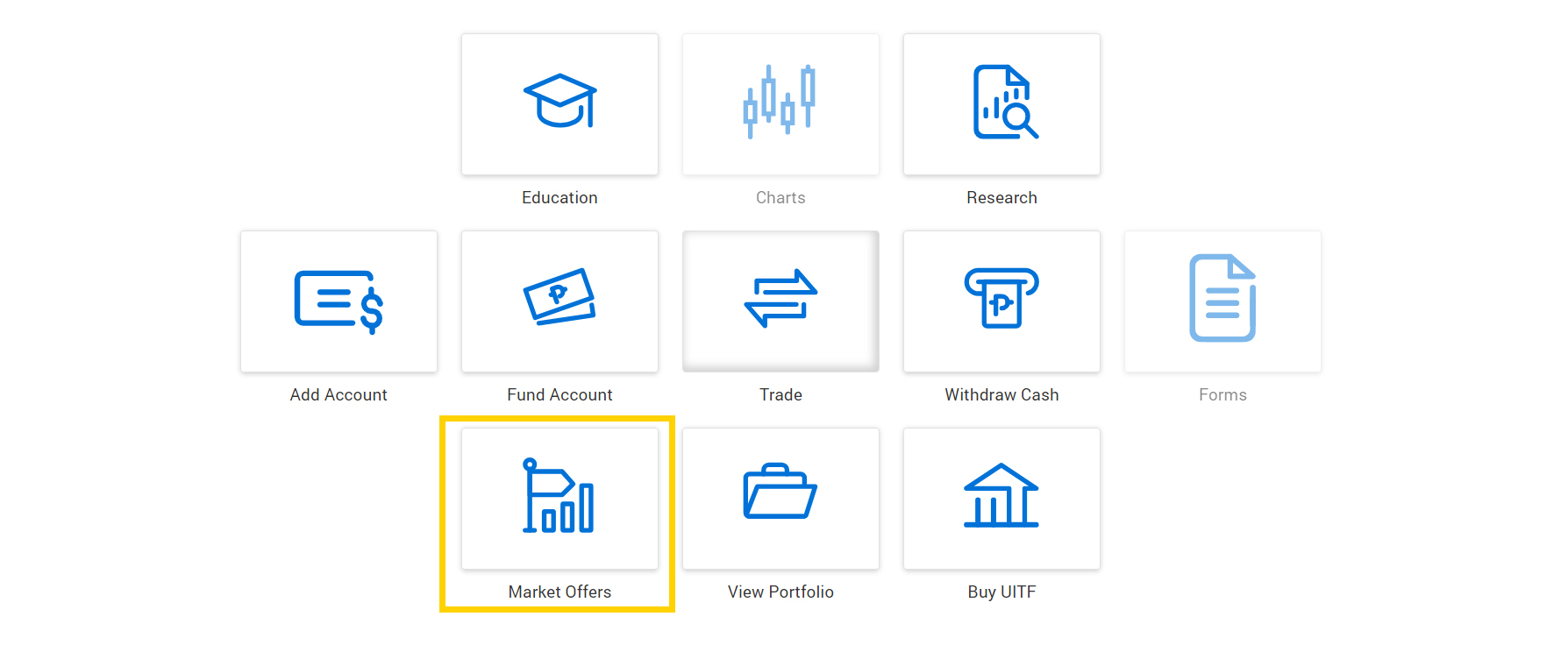

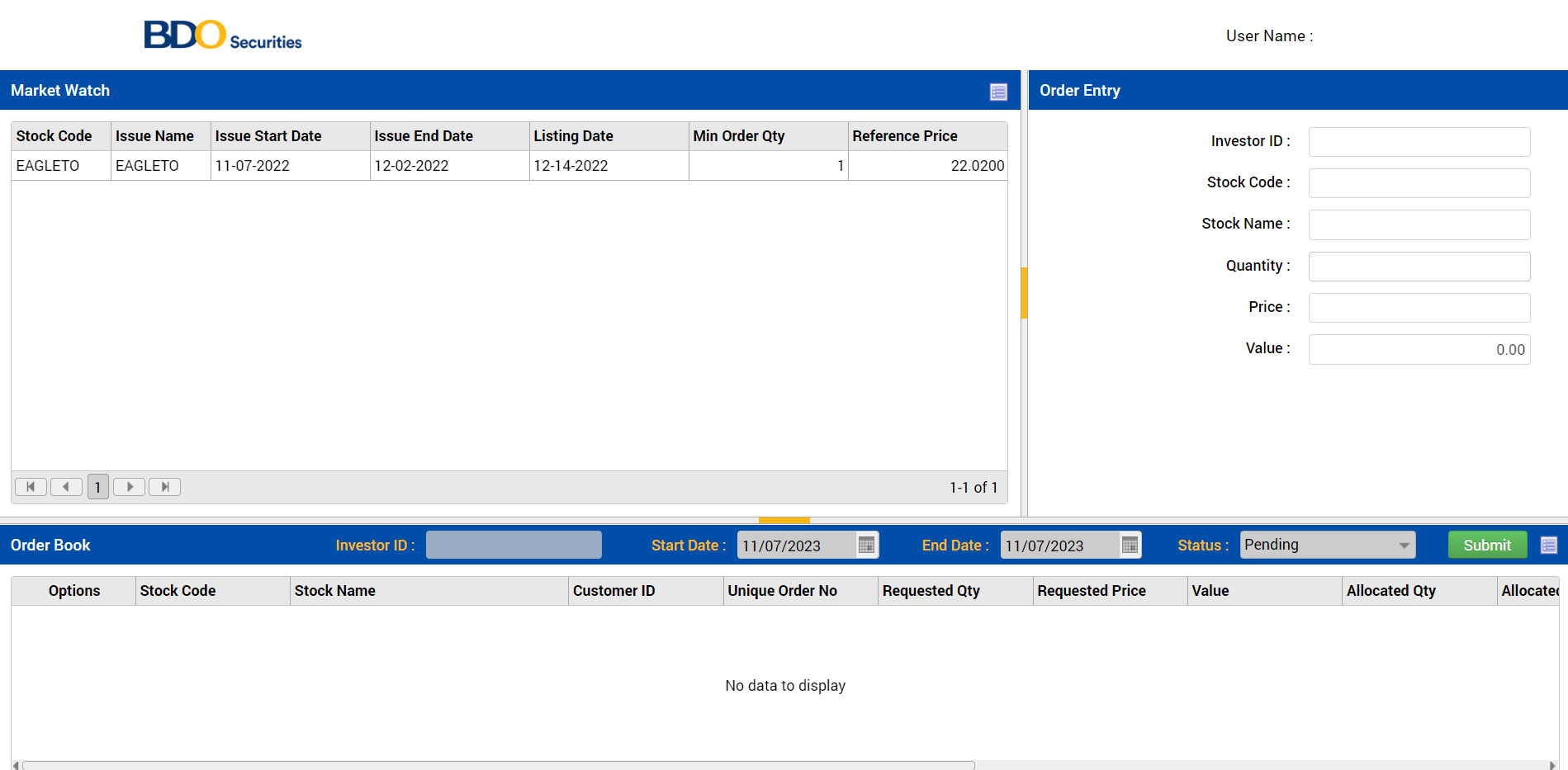

You could have done this by subscribing to the IPO through BDO Securities before the company even started trading.